We offer end-to-end support for investment vehicles structured as Special Purpose Vehicles (SPVs), managing every stage of the investment lifecycle. Our services encompass customized SPV structuring to isolate financial risk, effective capital raising for targeted projects, and ongoing portfolio management to enhance performance. With our specialized expertise, your SPVs benefit from streamlined administration, precise accounting, compliance with regulatory standards, and secure settlement processing. This allows you to focus on achieving your financial goals with minimized liability and optimized operational efficiency.

At the core of our services is a commitment to delivering comprehensive solutions for Special Purpose Vehicles (SPVs) used in investment strategies. Our approach covers every aspect of the SPV investment lifecycle, ensuring that your investment vehicle operates smoothly and efficiently.

Tailored SPV Structuring

We assist in structuring SPVs that effectively isolate financial risk, offering flexibility tailored to each unique investment objective. Our team works closely with you to establish the optimal structure to support your specific investment strategy.

Efficient Capital Raising

Leveraging our network and expertise, we support SPVs in securing capital from targeted sources, ensuring sufficient funding for projects and investments. Our approach enhances investor confidence and fosters streamlined fundraising.

Ongoing Portfolio Management

Our portfolio management services ensure that SPVs remain aligned with your financial goals. Through continuous monitoring and adjustments, we optimize portfolio performance and manage assets to maximize returns.

Administrative and Accounting Precision

With our streamlined administrative processes, your SPV benefits from efficient operational support, including precise accounting practices that ensure transparency and compliance. Our services allow you to focus on core investment activities without administrative burden.

Regulatory Compliance and Secure Settlements

Navigating complex regulatory requirements, we ensure your SPV operates in full compliance with relevant legal standards, minimizing exposure to compliance risks. Additionally, our secure settlement processing safeguards financial transactions, reinforcing investor trust.

By entrusting us with the setup and ongoing management of your SPV, you gain a partner dedicated to enhancing operational efficiency, minimizing liability, and supporting your journey toward successful financial outcomes.

We know how complex the decision path can be when you are planning a SPV. We know all about investment vehicles and are happy to help you through the process.

An SPV is a legally separate entity created specifically to isolate financial risk for a particular investment project, commonly used in private equity, real estate, and other specialized investments.

In both jurisdictions, SPVs are used for asset protection, facilitating joint ventures, managing real estate investments, and structuring private equity and venture capital transactions.

Luxembourg SPVs benefit from a favorable regulatory environment, with options like SCSp and RAIF that offer flexibility and minimal regulatory requirements. In Poland, SPVs must comply with local corporate laws and may face stricter oversight depending on the nature of their investments.

Luxembourg SPVs often benefit from tax neutrality, exemptions on dividends and capital gains, and no withholding tax on distributions, making it a tax-efficient jurisdiction for investment.

In Luxembourg, setting up an unregulated SPV like an SCSp or RAIF can take between 1-4 weeks due to minimal regulatory approval. In Poland, the process may take longer due to additional compliance checks and registration requirements.

Typically, SPVs in both jurisdictions are open to qualified or well-informed investors, particularly for private equity or real estate projects, though they may also include institutional and high-net-worth individuals.

SPVs in Poland and Luxembourg can hold a range of assets, including real estate, shares in companies, bonds, and other securities, depending on the investment strategy.

An SPV isolates the risk of the specific project it manages, protecting the parent company and investors from liability should the project face financial challenges.

In Luxembourg, unregulated SPVs have fewer reporting requirements, while regulated structures require more stringent compliance. In Poland, SPVs are generally subject to standard corporate reporting and tax filings.

Luxembourg offers greater flexibility, a tax-neutral environment, and minimal regulatory burden for certain SPV types (like RAIF and SCSp), which makes it attractive for international investment. Poland, however, may be preferable for domestic projects due to its familiarity with local legal and regulatory frameworks.

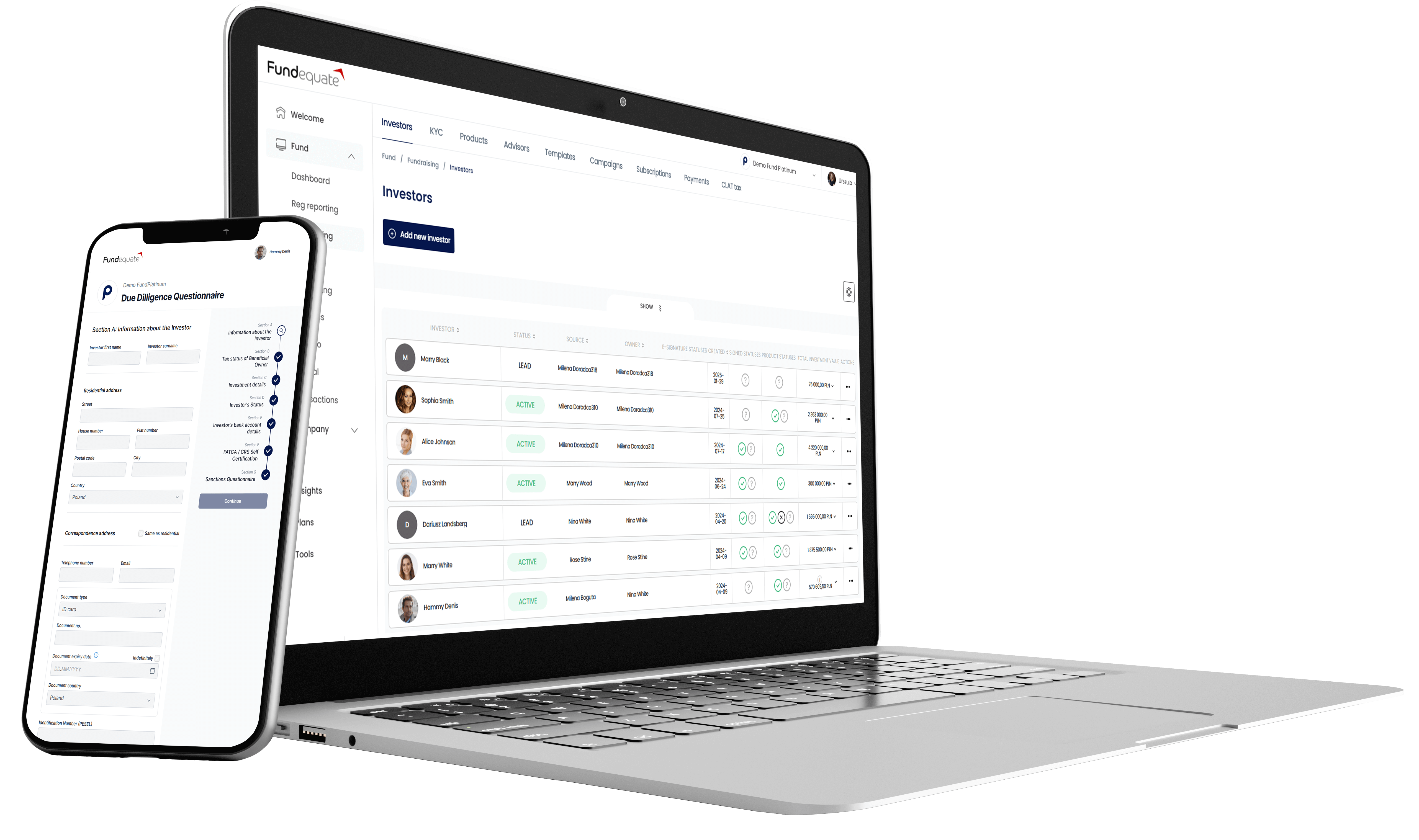

Schedule demo and find out how Fundequate can support your investment management business.