A white-label investor portal for VC/PE funds in Luxembourg provides a comprehensive, regulatory-compliant solution for managing investor distribution, onboarding, and automated fundraising. Fully aligned with CSSF regulations, AIFMD, and AML/KYC requirements (CSSF 21/782 & 12-02), it ensures seamless investor due diligence and compliance. The platform integrates advanced tools for secure communication, automated capital calls, private placement compliance, and periodic reporting per Invest Europe and SFDR ESG standards. By offering real-time investor access to fund performance and strategic insights, it enhances operational efficiency, transparency, and investor engagement, reinforcing Luxembourg’s position as Europe’s premier hub for alternative investments.

Fundequate Investor Portal simplifies onboarding and reporting, ensuring seamless access and transparency. Schedule an online consultation to see how we can support your fund.

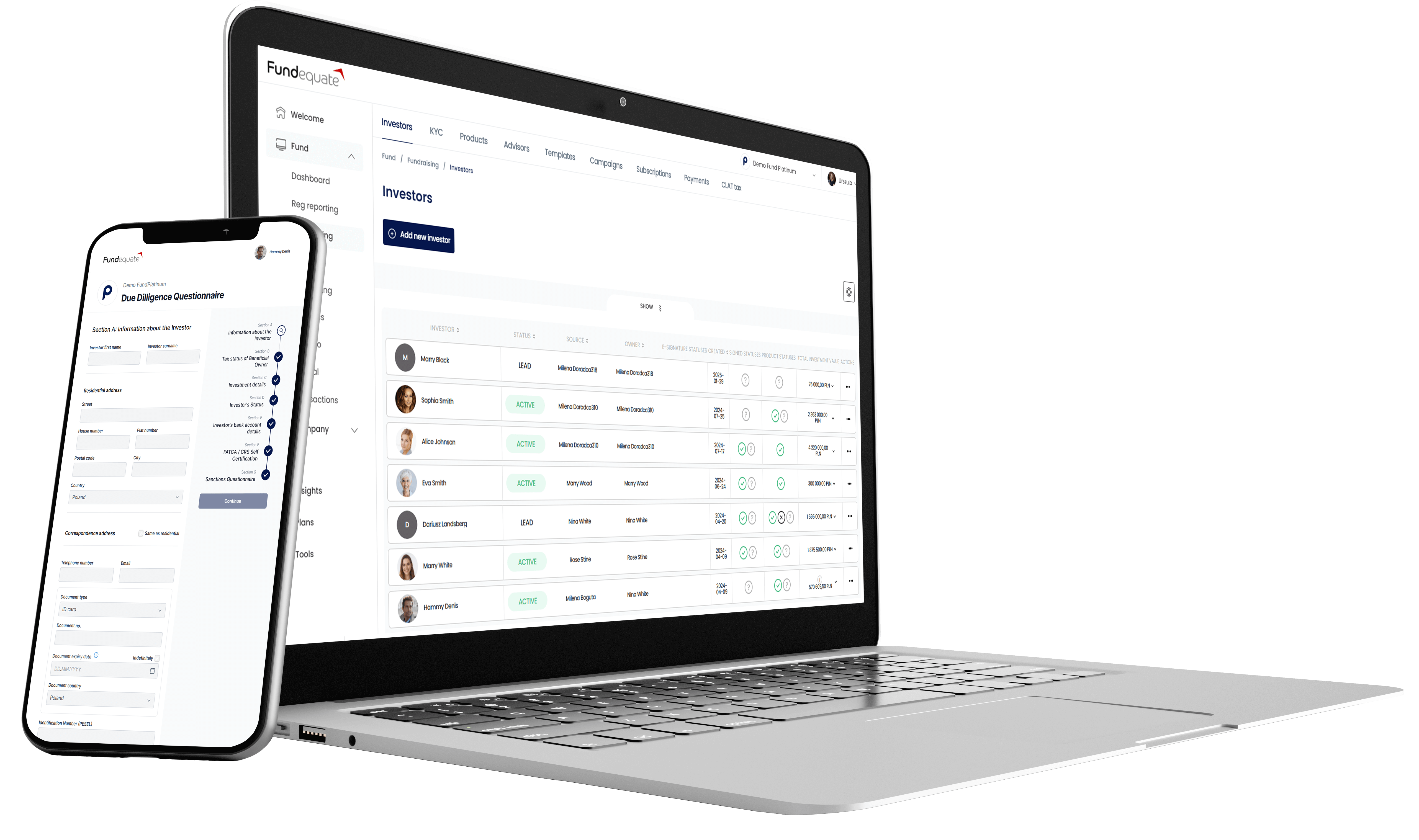

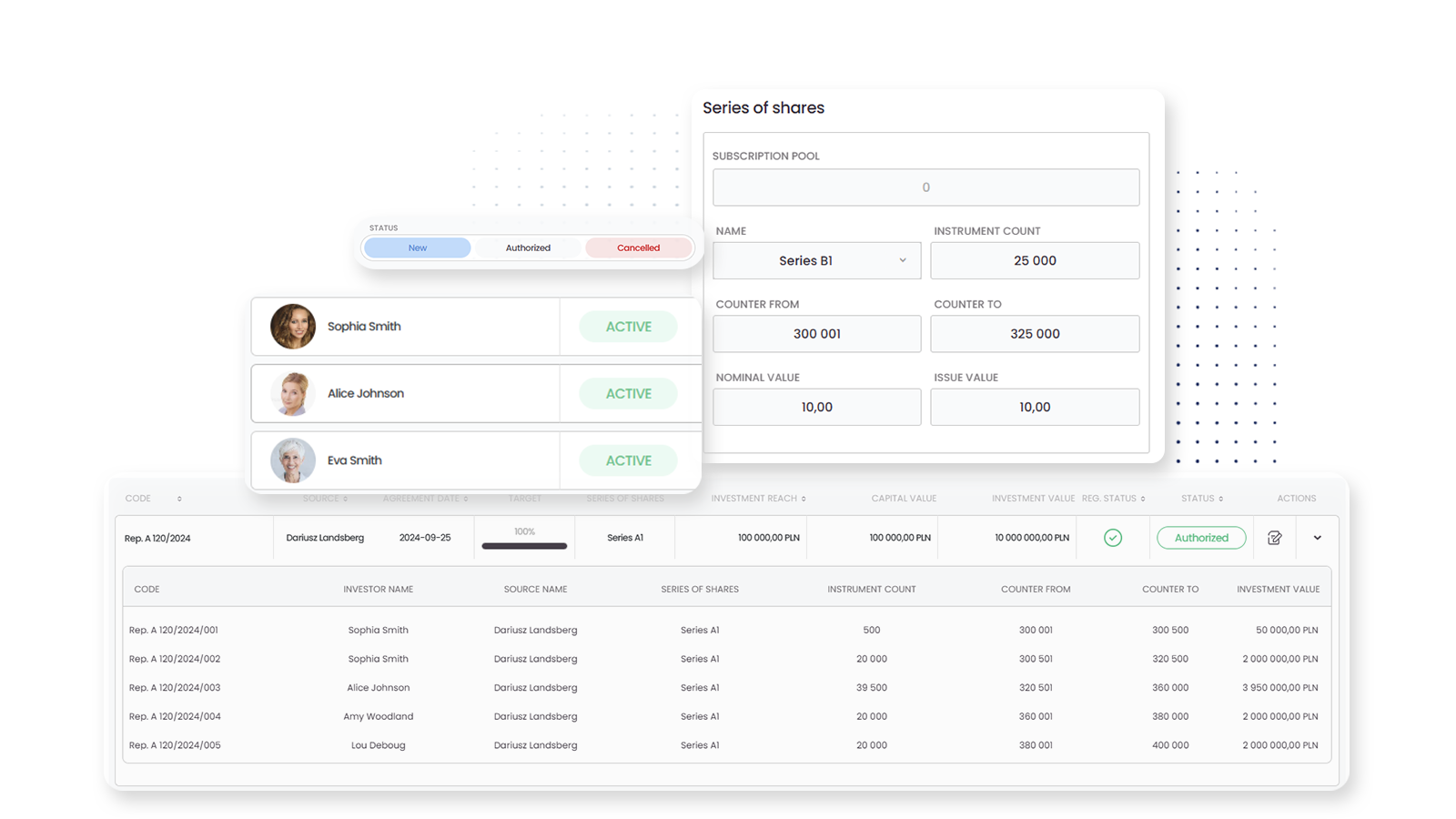

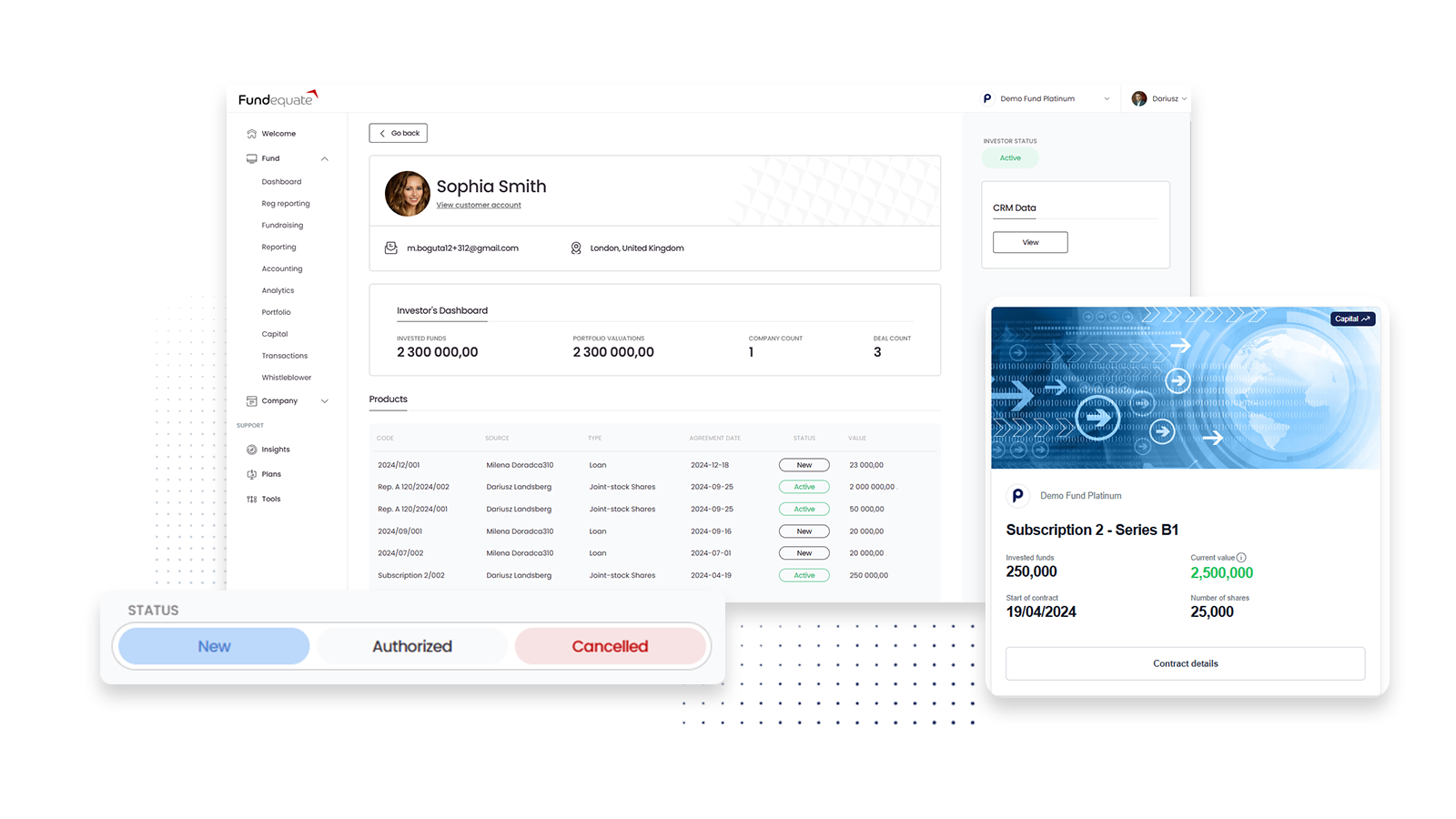

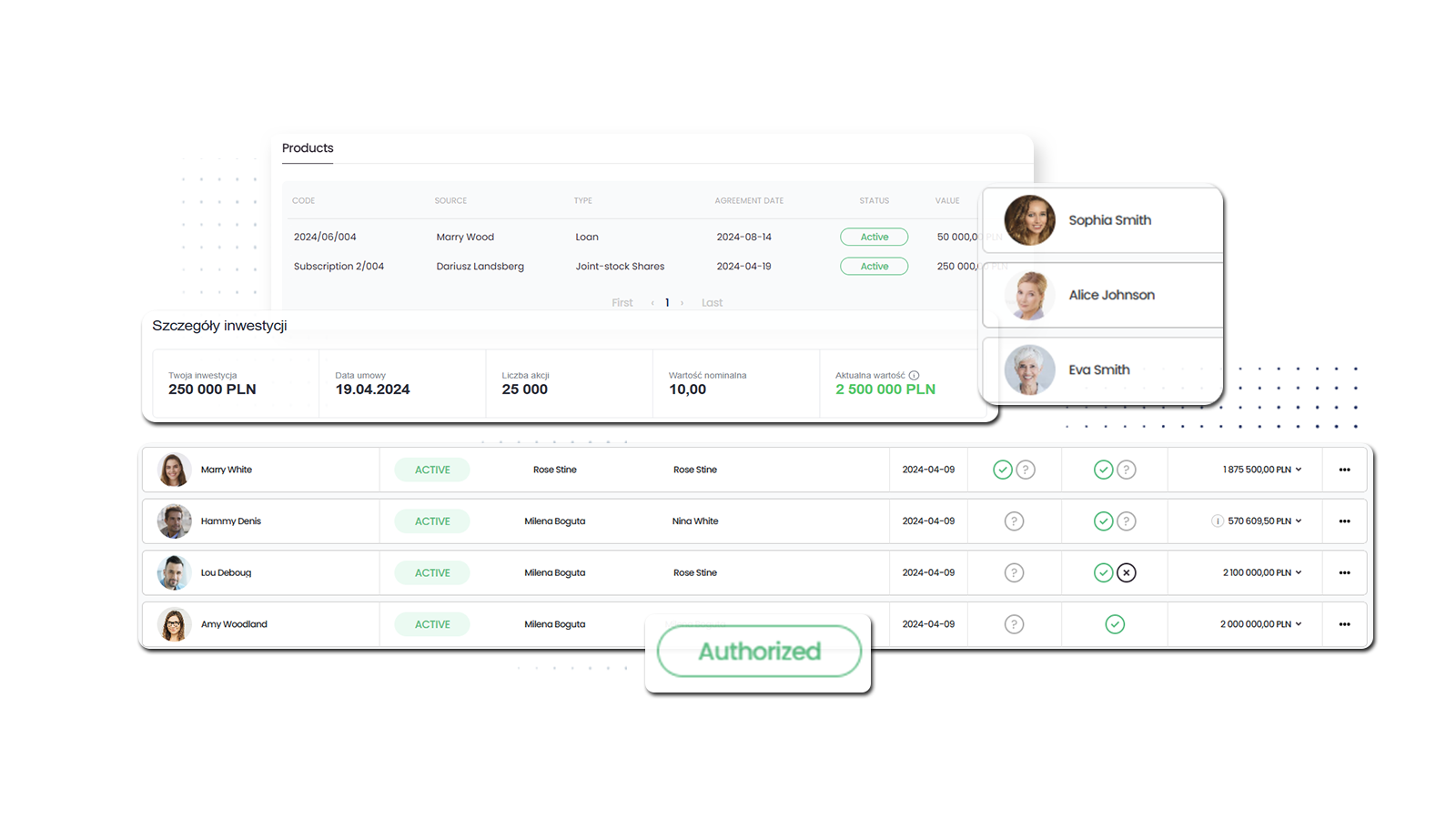

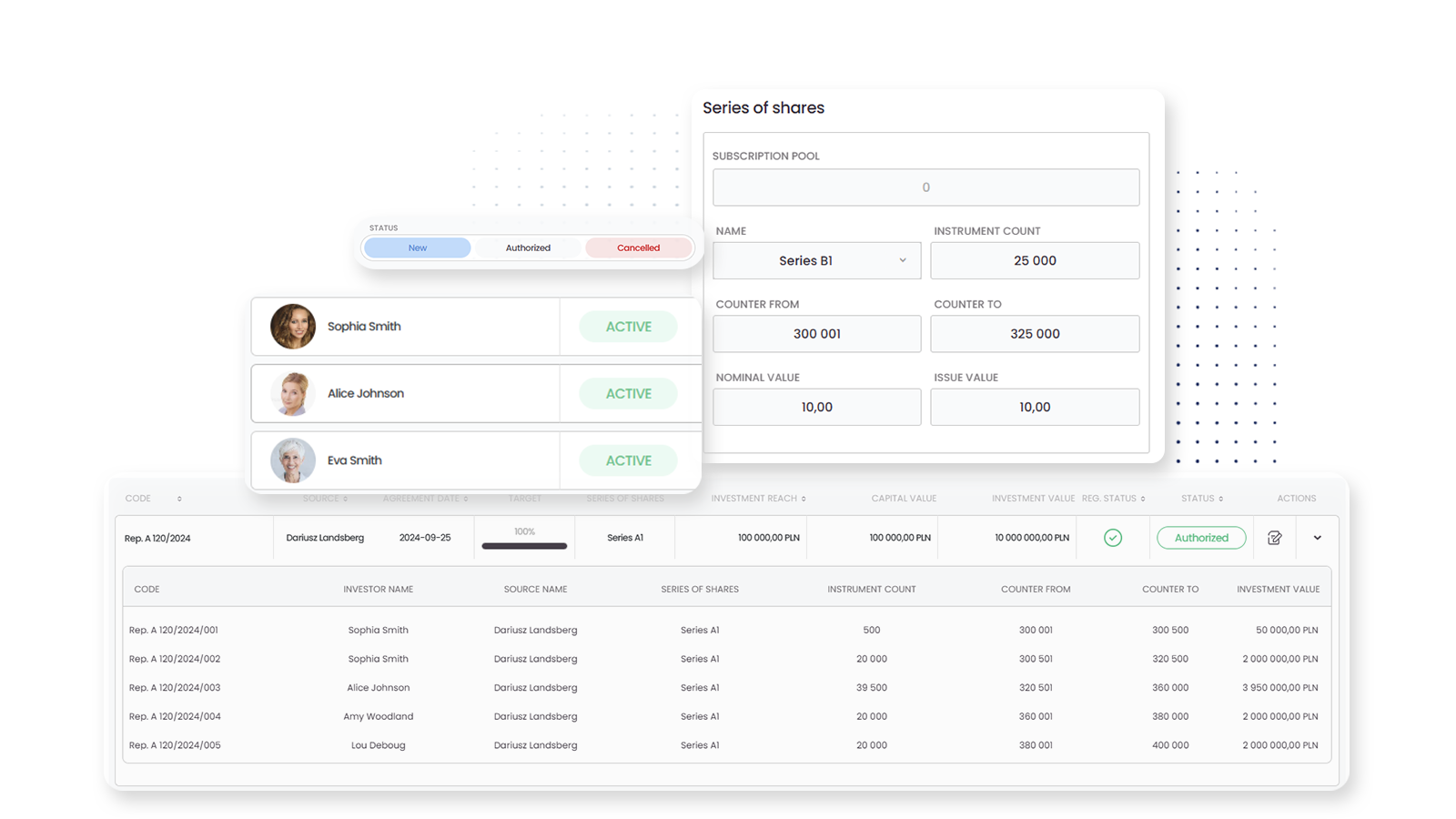

The investor portal manages the investor onboarding process, automates fundraising, distributes documents, reviews investment performance, communicates with investors and provides access to periodic reports and analysis.

Yes, the portal is offered in a fully customisable white-label model, allowing the fund to tailor the look and functionality of the platform to its brand and standards.

The portal enables the automation of fundraising processes, such as the management of offer documents, presentations, communication with potential investors and the monitoring of the progress of the process at each stage.

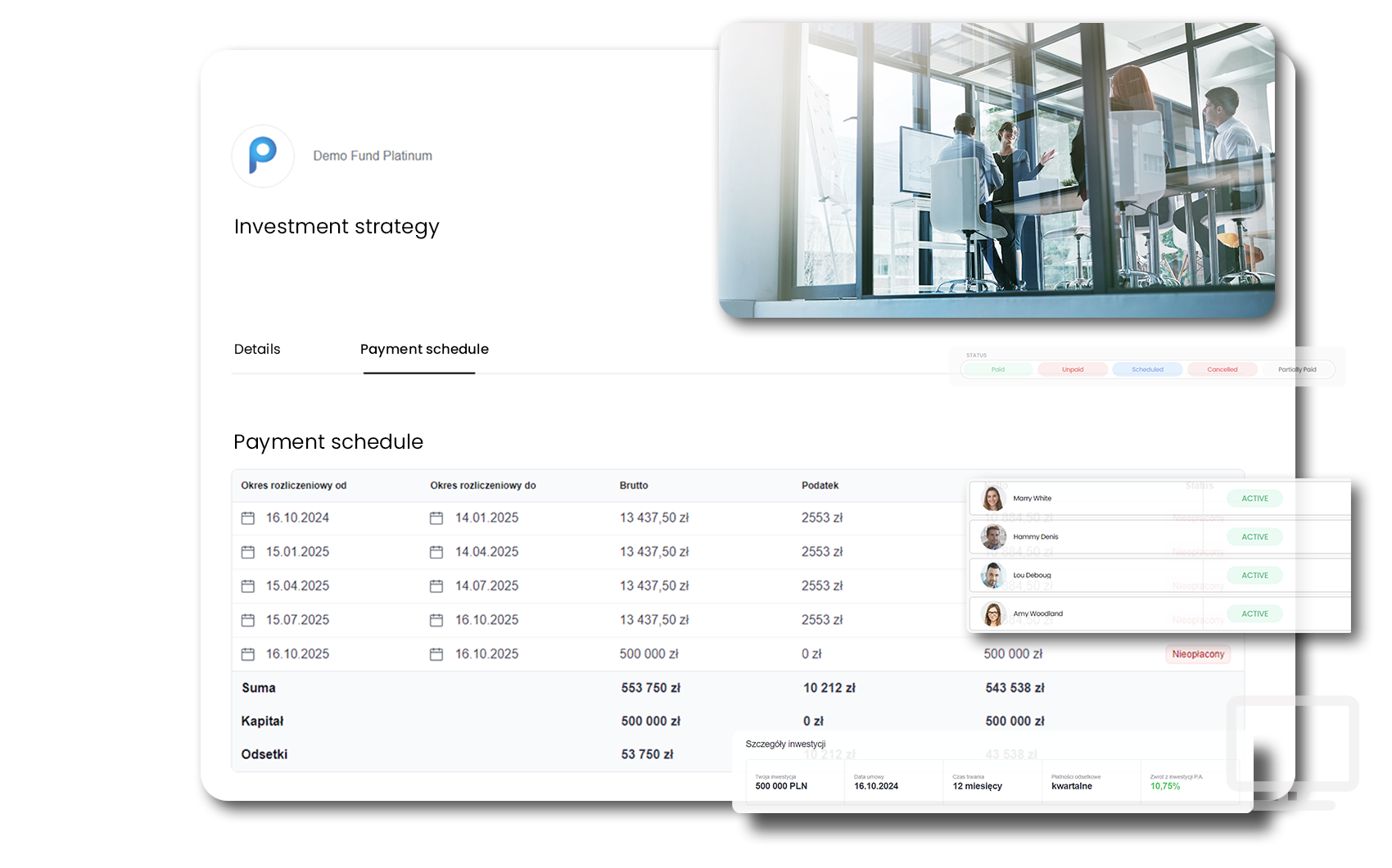

Yes, the portal provides access to up-to-the-minute data, analysis and periodic reports, enabling investors to keep up to date with the fund’s performance and key indicators.

The portal enables digital onboarding of investors by automating steps such as identity verification, reviewing KYC (Know Your Customer) documents and signing contracts online.

Investors have convenient, 24/7 access to investment performance, documentation, analysis, and can communicate with fund managers and monitor the progress of their investments.

Yes, the portal supports the automation of the distribution of funds, such as dividend payments and other benefits to investors, ensuring transparency and accuracy in the management of the flow of funds.

Yes, the investor portal uses advanced security features such as data encryption, two-factor authentication and continuous security monitoring to protect sensitive information.

The portal allows the management of investor communications, including sending messages, notifications and publishing announcements and reports, facilitating regular contact and relationship building.

Costs depend on the number of functionalities, the number of investors served and other factors, so it is worth contacting the provider for a detailed quote tailored to the fund’s needs.

Schedule demo and find out how Fundequate can support your investment management business.