We know how complex the decision path can be when you are planning a new fund. We know all about alternative funds and are happy to help you through the process.

VC fund reporting platforms provide managers and investors with access to full performance analytics, portfolio monitoring and a transparent flow of information.

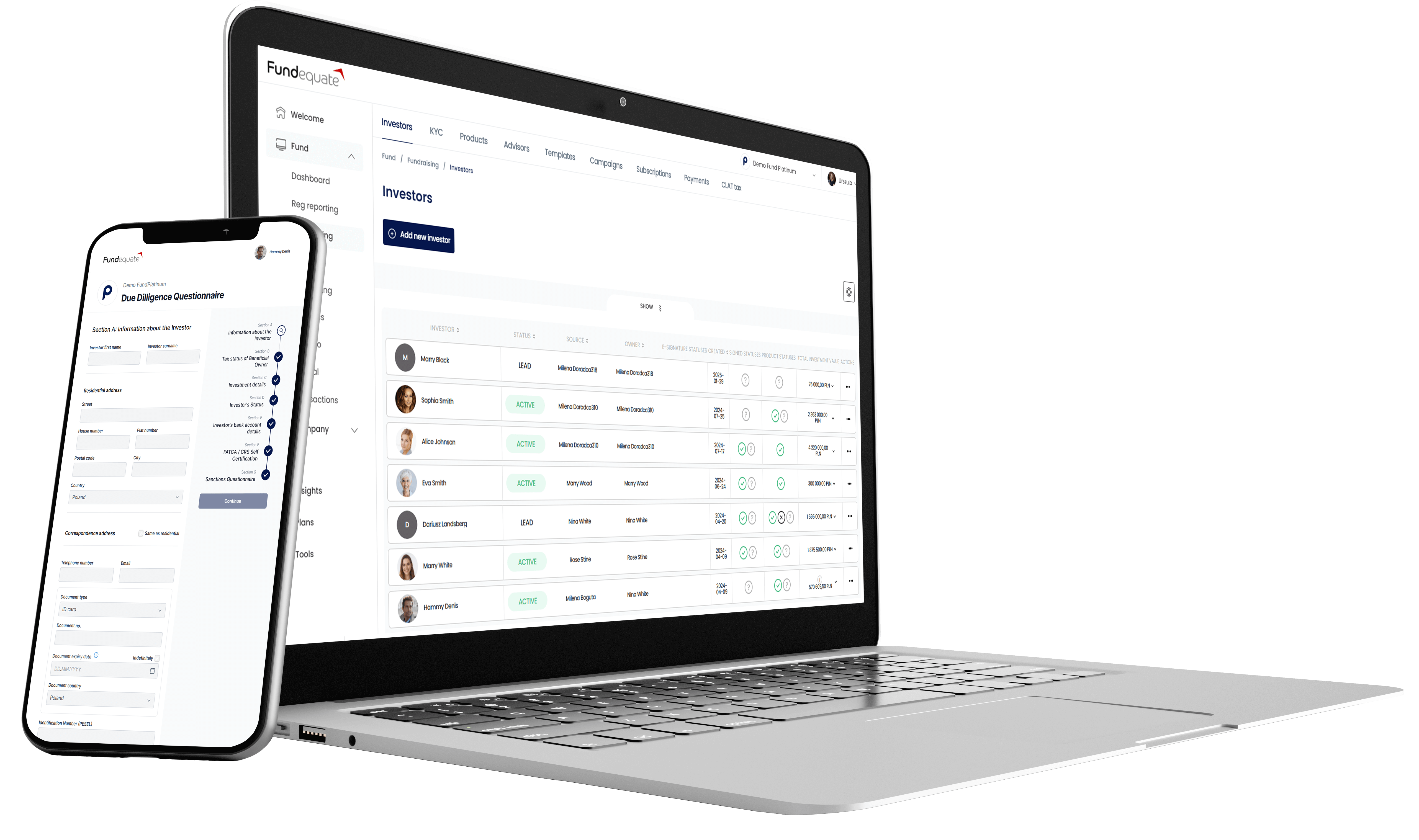

These platforms typically automate the onboarding of LPs, enabling rapid documentation collection, data validation and secure creation of investor accounts.

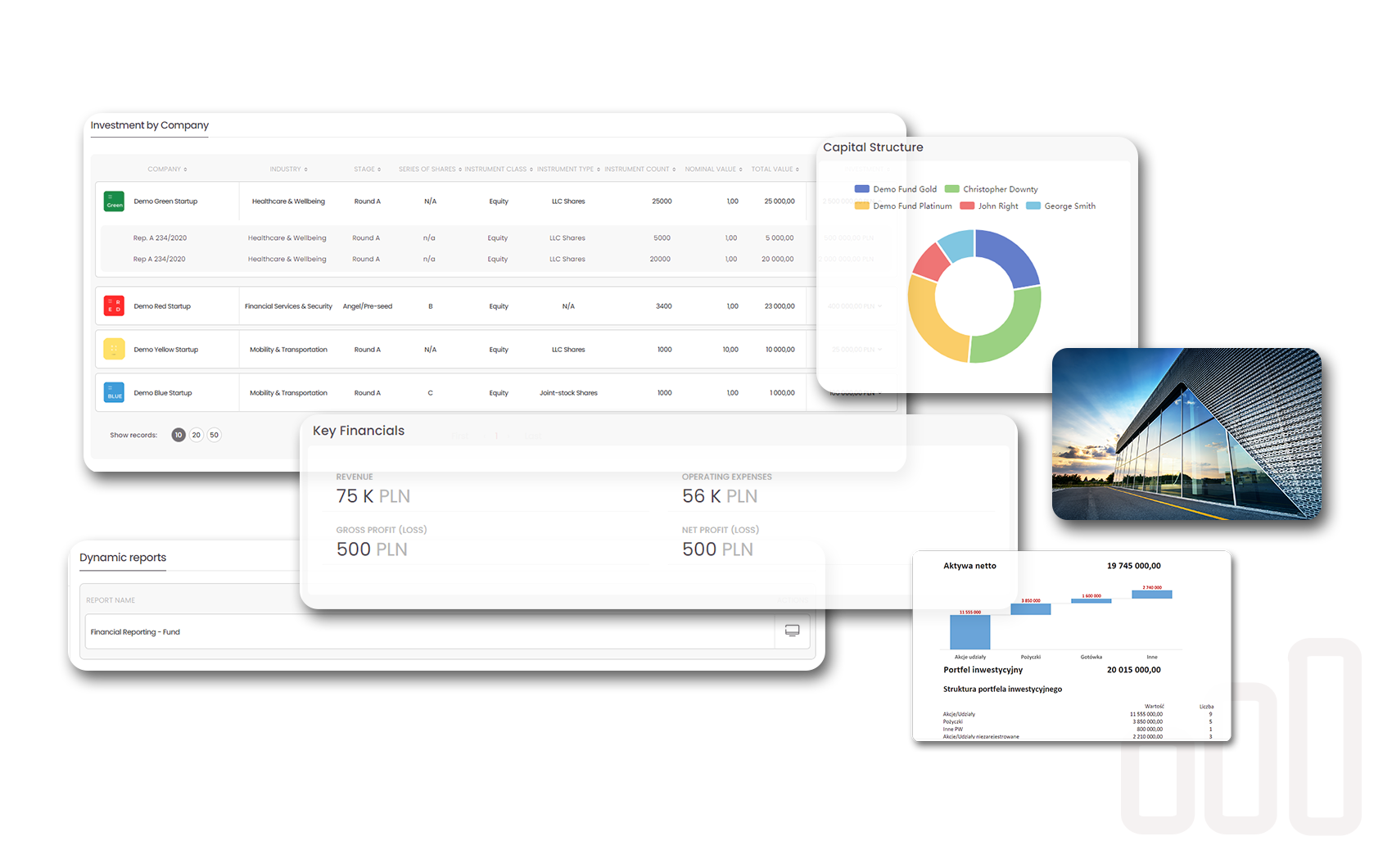

These platforms offer advanced BI tools such as investment performance metrics, forecasting, risk analysis and reporting on key financial indicators.

Yes, most platforms allow the creation of reports tailored to investors’ specific requirements, including repayment schedules, returns and investment details, among others.

Yes, it provides a real-time view of investment performance, allowing investors to monitor performance and maintain control over their portfolios.

Investment platforms often integrate accounting systems and financial tools, automating accounting processes and reporting financial results.

Most platforms provide regulatory compliance features that meet the requirements of various jurisdictions, including automation of reports to financial supervisors.

Key metrics such as return on investment, IRRs, portfolio realizations and cost structures are available on the platforms.

Yes, most platforms support functions for distributing profits and managing repayment schedules for investments.

These platforms typically use advanced data protection methods, such as encryption and multi-level authentication, to ensure that investors’ and the fund’s information is fully secure.

Schedule demo and find out how Fundequate can support your investment management business.