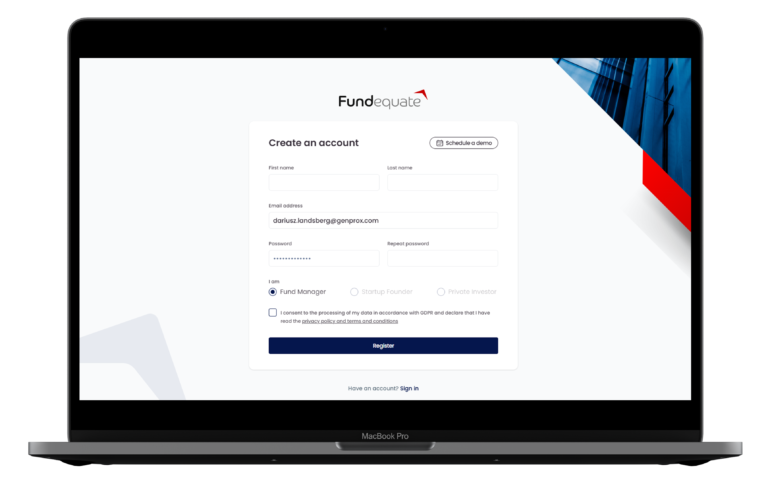

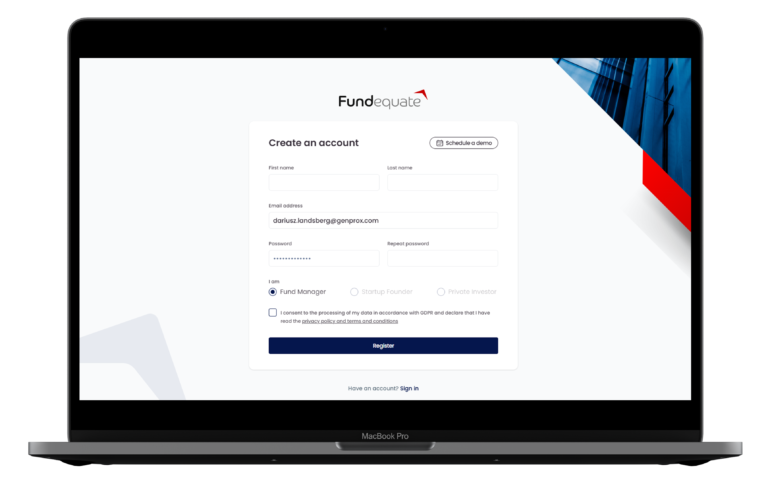

Register on fundequate.com using your business email address from the fund's domain. On the platform you will find the details of all AIFMs and their AIFs based on the Polish FSA register, which will allow us to assign you to your fund.

Managers of Alternative Investment Companies (AIFCs), pursuant to Article 110 of Regulation 231/2013, are required to report regularly to the Financial Supervision Authority (FSA). These reports must be submitted annually and the deadline for submission for a calendar year is 31 January of the following year, assuming that the AIFM was entered in the FSC register before the end of the third quarter of the previous year. If the AIFM is entered in the FSA register in the fourth quarter, it is not subject to the obligation to prepare and submit an annual report to the FSA at all. The annual report of the AIF Manager is submitted by the Alternative Investment Company Manager in XML format through the Electronic System for the Transmission of Information (ESPI). The AIF Manager prepares the XML files based on the financial data of the AIFs it manages.

Trust the experts in ASI reporting

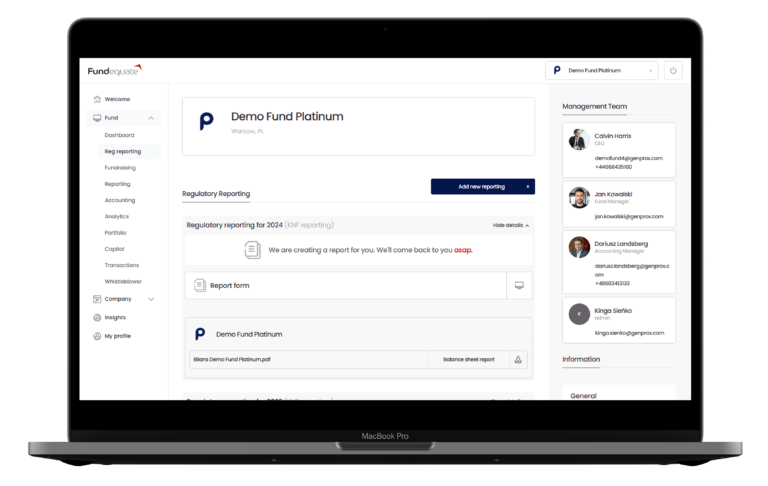

Fundequate and Genprox are proven market leaders in AIF reporting to the FSA. Our experience of working with Alternative Investment Companies allows us to respond accurately to reporting requirements, minimising the risk of errors and delays. Thanks to our close cooperation with numerous investment funds, we know the challenges faced by our clients and how to meet them effectively. Our services are a guarantee of correct and timely fulfilment of reporting obligations.

Comprehensive support in the preparation of DATMAN and DATAIF reports

Reporting to the FSA requires particular precision and compliance with current legal guidelines. Fundequate and Genprox specialists comprehensively handle the entire process, from the preparation of DATMAN and DATAIF files in XML format to their correct transmission through the ESPI system. Our expertise covers the full range of information required by the FSA, including detailed reports on financial instruments, assets and geographical and sectoral concentration of investments.

Automation and assurance – reporting without complications

When you work with us, you are assured that the reporting process runs smoothly and safely. Fundequate and Genprox use state-of-the-art technology to automate the preparation of reports, so we minimise the risk of mistakes and ensure full compliance with FSA requirements. By entrusting us with the reporting service, you can focus on the development of your fund, leaving the formal aspects in the hands of experienced specialists.

With the Fundequate platform combined with the experience of our analysts, you can be sure that the reports generated are 100% correct and in accordance with the requirements of the FSA. If necessary, we will clarify the details of your fund's report with the FSA and our analysts can prepare additional statements.

For the past 6 years, we have been providing our clients with the service of reporting to the FSA, servicing 70% of market assets in Poland. We provide a guarantee of compliance with legal regulations and FSA guidelines. At the same time, as a trusted entity, we ensure the confidentiality and security of the data entrusted to us.

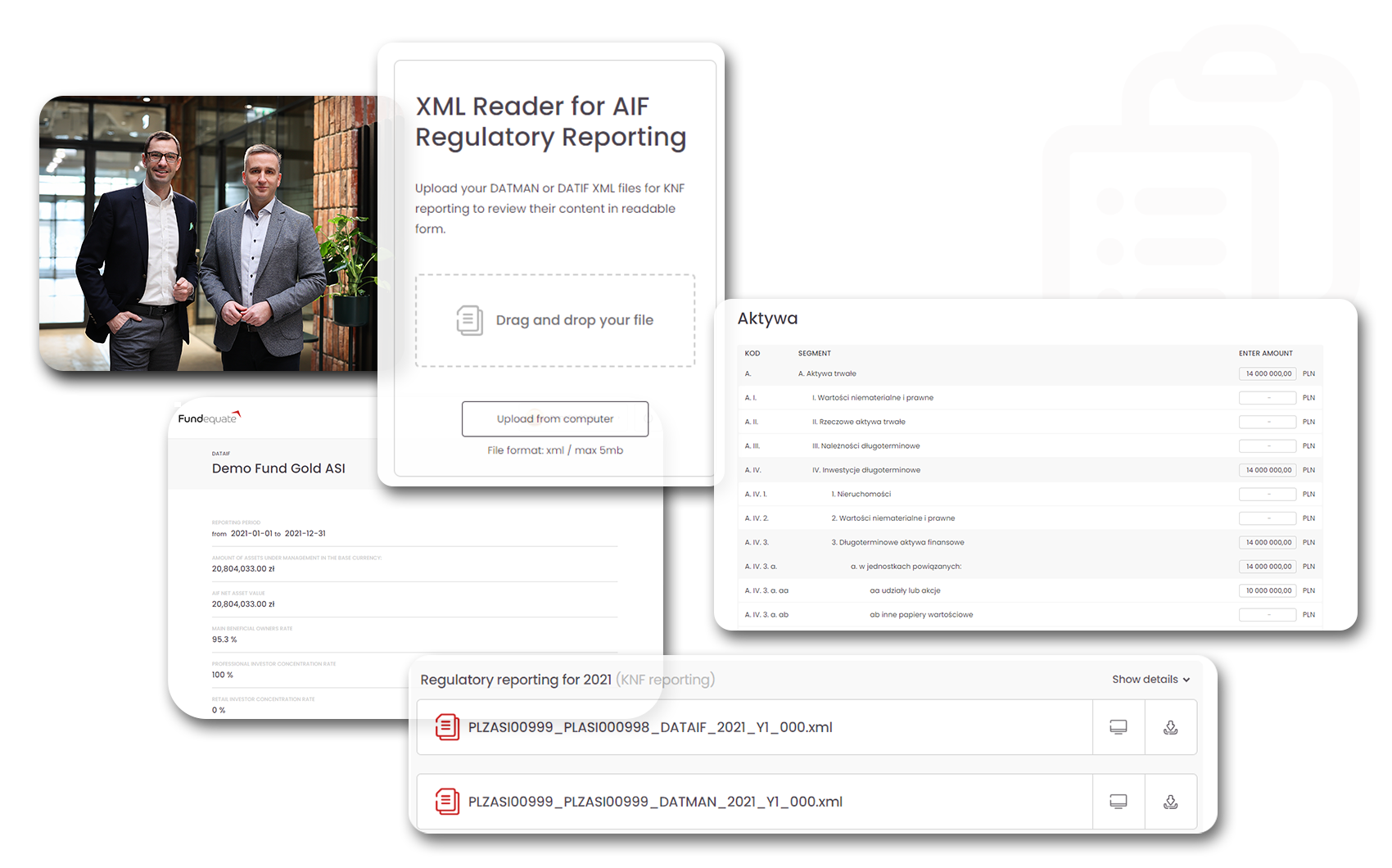

By preparing DATMAN and DATAIF files on the Fundequate platform, you gain access to your reporting data, including all portfolio analytics. We give you a bundled XML reader that allows you to intuitively read the DATMAN and DATAIF report files submitted to the FSA in ESPI.

Register on fundequate.com using your business email address from the fund's domain. On the platform you will find the details of all AIFMs and their AIFs based on the Polish FSA register, which will allow us to assign you to your fund.

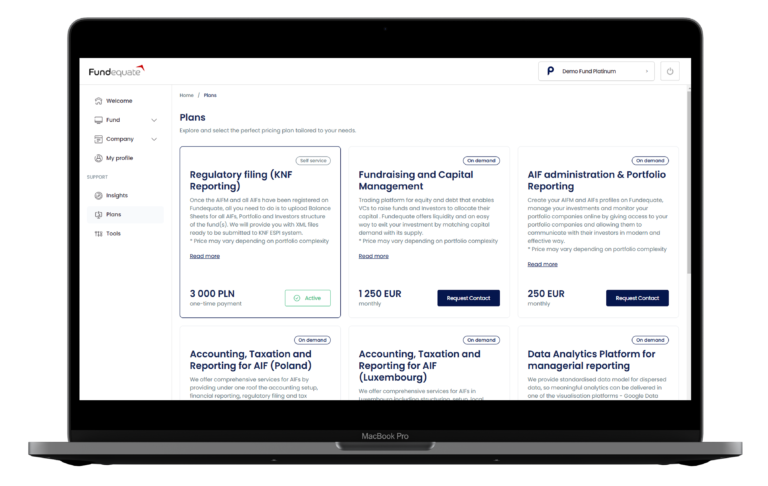

In the available plans, select Regulatory filing (KNF Reporting), then choose your fund from the list and click “Join the fund” if you are not yet assigned to it. Our team will verify your access rights. Please register using your fund’s domain email address. This will allow you, in the next step, to accept the agreement online and activate the service. For clients continuing the service in the following year, after selecting the plan and accepting the agreement, the wizard redirects the user to the Regulatory Reporting module, where the next reporting period (reporting for 2025) should be selected.

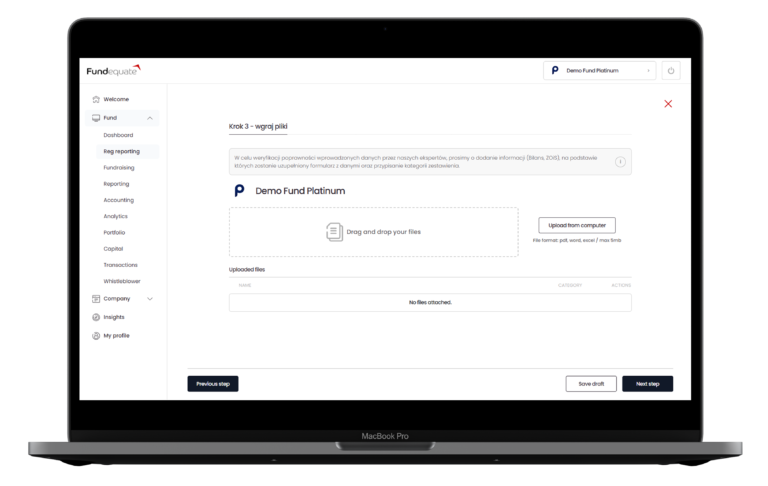

For each AIF under the management of a given AIFM or for a internally-managed AIF, upload the financial statements in XML format as at 31 December, or enter the main balance sheet data manually in an intuitive wizard.

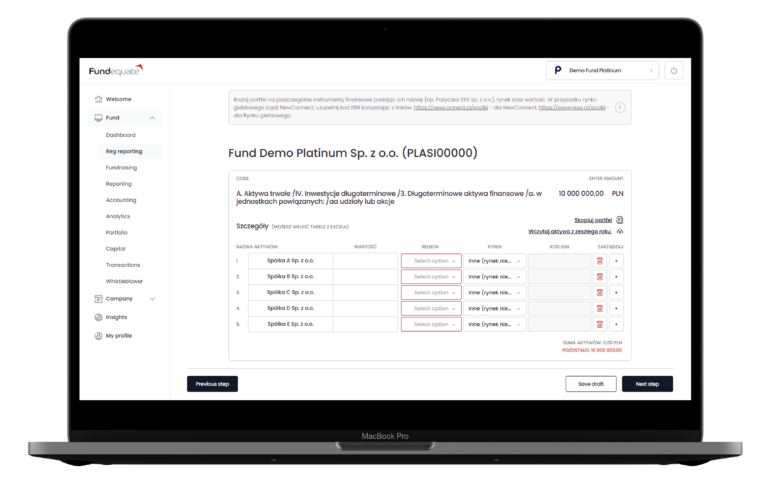

In this step, the names of the companies or financial instruments in which the ASI has invested must be broken down into individual names. The wizard requires an analytical breakdown for each of the financial asset items shown on the ASI balance sheet in the previous step.

Once you have entered the necessary data required by the wizard, the DATMAN and DATAIF reports will be verified by our analysts. Within 2 business days you will receive notification that the files are ready and available in your account for downloading and uploading to ESPI. If necessary, our analysts can file your fund's reports in ESPI on behalf of your fund and you will also find confirmation of this dispatch on Fundequate.

One-off fee for AIFM (VAT exempt)

* The rate of PLN 3,000 applies in total for a ZASI with one ASI or for an internally managed ASI. Our service is exempt from VAT (ASI management services with ZW rate).

What do you get?

The DATMAN and DATAIF reports submitted to the Financial Supervision Authority (FSA) by the Alternative Investment Company Managers (AIFMs) contain detailed information on the investment activities of all AIFMs. These reports are mandatory and aim to ensure transparency of the activities of AIFs towards the FSC. The FSC forwards the reports it receives to ESMA (European Securities and Markets Authority).

The ESPI system is the Electronic System for the Transmission of Information managed by the FSC, which is used by market participants to submit reports required by the regulator. AIFMs are required to access ESPI by submitting an application to https://www.knf.gov.pl/dla_rynku/espi. Once granted access to ESPI, ASI Managers are required to report via ESPI. Read more about mandatory reporting for ZASIs at: https://genprox.com/blog/nowe-obowiazki-informacyjne-zasi-do-knf-od-1-stycznia-2024/

The DATMAN and DATAIF reports to the FSA provide data on the fund’s main financial instruments and assets, investment strategies and the degree of geographical and sectoral concentration of investments. In addition, ZASI must include information on the markets in which the fund operates or trades.

ASI managers entered in the register of AIFMs kept by the FSA before 30 September last year are subject to the obligation to submit a report to the FSA for the past year by the end of 31 January of the following year. However, if the entry of an ASI was made in Q4, it does not submit a report for that period until 31 January of the following year. The same applies to subsequent registered AIFs under AIFM management – those entered in the FSA register are reported by the end of Q3.

Fundequate is the only entity in the market to offer a DATMAN and DATAIF file reader that allows you to read the structure of the ZASI reports to the FSA in a friendly format and save the report as a PDF. The reader is available after registration on Fundequate at: https://platform2.fundequate.com/fund/reg-reporting/knf-xml-preview

The only DATMAN and DATAIF XML file reader available on the market is free of charge when you register on the Fundequate platform as a Fund Manager. More at: