Are you looking to set up or support an Alternative Investment Fund (AIF) in Luxembourg or Poland? Our experts supported by dedicated platform provide end-to-end solutions for unregistered AIFs, making fund management, compliance, and investor relations easier and more efficient. With expertise in Luxembourg and Poland regulatory landscape, we offer comprehensive support for AIF structuring, registration, and ongoing administration in these both jurisdictions. Our core services include:

Fund Structuring and Domiciliation: Establish a robust fund structure that aligns with flexible legal framework. We handle domiciliation and provide experienced director representation to ensure your fund’s local presence.

Administration and Accounting: Keep your fund compliant and transparent with meticulous accounting, taxation, and reporting services. We manage the complexities of capital calls, portfolio monitoring, and regulatory requirements, tailored to AIFs operating in Europe.

Investor Onboarding and Compliance: Our platform streamlines capital raising and investor onboarding, ensuring a smooth journey from subscription to active management. We prioritize AML/KYC compliance, aligning with Luxembourg and Poland high standards for investor protection.

Regulatory and Statutory Reporting: As Luxembourg’s regulations evolve, so do our solutions. We provide seamless regulatory and statutory reporting to keep your AIF in good standing, covering requirements from the AIFMD to tax filing.

Partner with us for a reliable, knowledgeable, and transparent experience in Luxembourg and Poland AIF sector. Our team is dedicated to supporting AIFMs and investment managers every step of the way, facilitating effective fund operations across Europe.

Fundequate provides Luxembourg AIFMs with a complete platform for fund structuring, compliance, and administration. Our technology-driven solutions streamline setup, regulatory reporting, and investor relations, ensuring smooth operations and long-term growth in line with Luxembourg standards.

Fundequate offers a full-service platform for AIFMs in Poland, covering fund structuring, compliance, and administration. Our technology-enhanced solutions simplify setup, regulatory reporting, and investor onboarding, supporting efficient operations and sustainable growth within Poland’s regulatory framework.

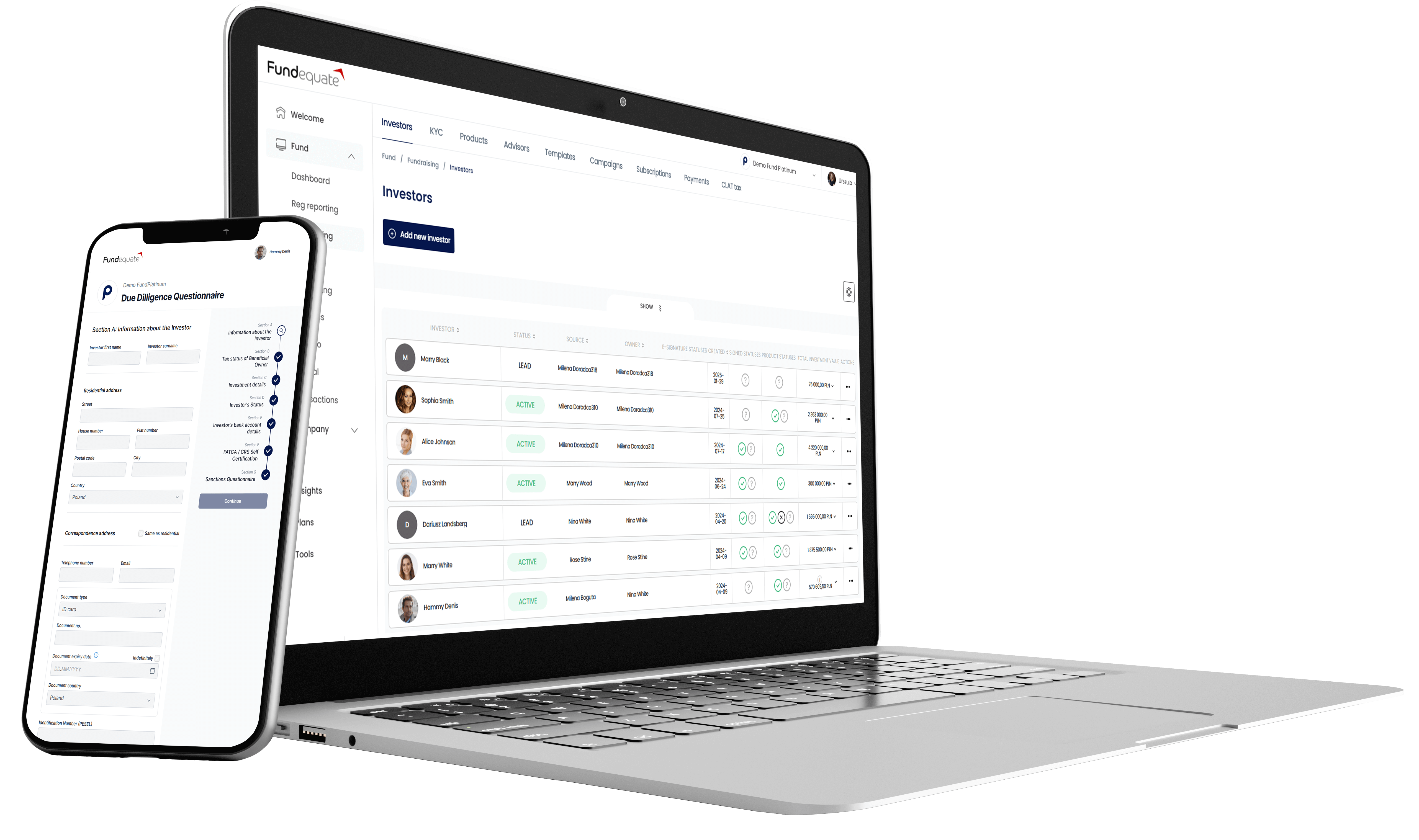

Information and product campaigns, distribution network management, investor onboarding and fund capital records. Paperless subscription and allocation of shares fully online.

An investor portal integrated with the fund's or issuer's website, together with investor and adviser dashboards allowing for investor onboarding, AML and KYC and sales network management.

Structuring, registration and management of Alternative Investment Funds and ASIs in Poland and Luxembourg, fully online without paper thanks to the Fundequate platform.

AIF capital accounting, share subscriptions, allocations, portfolio records, valuations, and management fees, all streamlined by AI. Analytics and insights are available online.

Generator of DATMAN and DATAIF reports to the KNF for AIF Managers and reader of AIF XML reports to the KNF. An intuitive module to generate reports under the control of our experts.

An intuitive and simple module to introduce in 15 minutes the process of protecting Whistleblowers (Whistleblower Law) in a VC/PE fund operating as Alternative Investment Fund.

We know how complex the decision path can be when you are planning a new fund. We know all about alternative funds and are happy to help you through the process.

Commonly, unregulated AIF structures include the SOPARFI (financial holding company), SCS (common limited partnership), and SCSp (special limited partnership), providing flexibility without direct CSSF supervision.

Unregulated AIFs are typically open to well-informed, institutional, or professional investors rather than retail investors.

The SCSp does not have its own legal personality, unlike the SCS, making it a more flexible and confidential choice, akin to common law limited partnerships.

Unregulated structures offer greater flexibility in setup, reduced regulatory obligations, and faster time-to-market, with fewer ongoing compliance requirements.

If the AIF meets “under-threshold” criteria (below €100 million in assets or €500 million for unleveraged funds without redemptions), it can operate without an AIFM. Otherwise, an AIFM is required.

Structures like SOPARFI and SCSp are generally tax-neutral or tax-transparent, potentially benefiting from Luxembourg’s tax treaties, which may reduce withholding taxes on foreign income.

SOPARFI is a commercial company used as a holding structure for investments in private equity or venture capital, often chosen for its flexibility and tax-neutral status.

Partnerships like SCSp offer confidentiality since limited partners’ information isn’t publicly disclosed, unlike other regulated entities.

No, only regulated AIFs managed by authorized AIFMs benefit from the AIFMD passport. Unregulated AIFs must follow local private placement rules in each jurisdiction.

Unregulated AIFs in Luxembourg have minimal ongoing requirements, primarily focusing on annual financial statements and compliance with any applicable tax and corporate governance regulations.

In Poland, common AIF structures include closed-end investment funds (FIZ), open-end investment funds (FIO), and specialized open-end investment funds (SFIO), with each serving different investment and regulatory needs.

The Polish Financial Supervision Authority (KNF) oversees AIFs, ensuring they comply with local regulations and the EU’s Alternative Investment Fund Managers Directive (AIFMD).

Typically, Polish AIFs are targeted toward professional, institutional, or well-informed investors rather than retail investors, especially for funds involving complex or high-risk strategies.

Setting up an AIF involves regulatory approval from the KNF, which includes providing documentation on fund structure, risk management, and compliance plans, as well as appointing a licensed AIFM if required.

Yes, AIFs with assets above the AIFMD threshold (€100 million with leverage or €500 million without leverage) require an authorized AIFM. For under-threshold funds, a registered AIFM may suffice.

Polish AIFs may benefit from preferential tax treatments, especially when structured as closed-end investment funds (FIZ), which often receive tax exemptions on income, subject to specific conditions.

Yes, AIFs managed by authorized AIFMs can use the AIFMD passport to market across the EU, provided they meet cross-border compliance requirements.

AIFs must regularly report to the KNF, including financial disclosures, risk management reports, and compliance updates to maintain transparency and regulatory compliance.

Polish AIFs must adhere to investor protection standards, including clear risk disclosure, compliance with AML/KYC requirements, and safeguarding investor assets through appointed depositories.

While AIFs in Poland have broad flexibility, they must comply with KNF regulations on risk management, diversification, and in some cases, concentration limits to protect investors.

Schedule demo and find out how Fundequate can support your investment management business.