Luxembourg’s tax-transparent SCSp (Special Limited Partnership) provides an optimal structure for investment syndicates, especially for business angels and private investors. This structure offers flexibility, tax efficiency, and alignment with European regulatory frameworks. Here’s how Fundequate supports the lifecycle of an SCSp-based investment syndicate:

Structuring and Registration

Capital Raising and Investor Onboarding

Ongoing Administration and Compliance

Investment Monitoring and Reporting

Exit and Settlement

Luxembourg’s SCSp, coupled with Fundequate’s local expertise and platform capabilities, enables investment syndicates to operate with efficiency, transparency, and compliance, offering a robust solution for both seasoned and emerging investment groups.

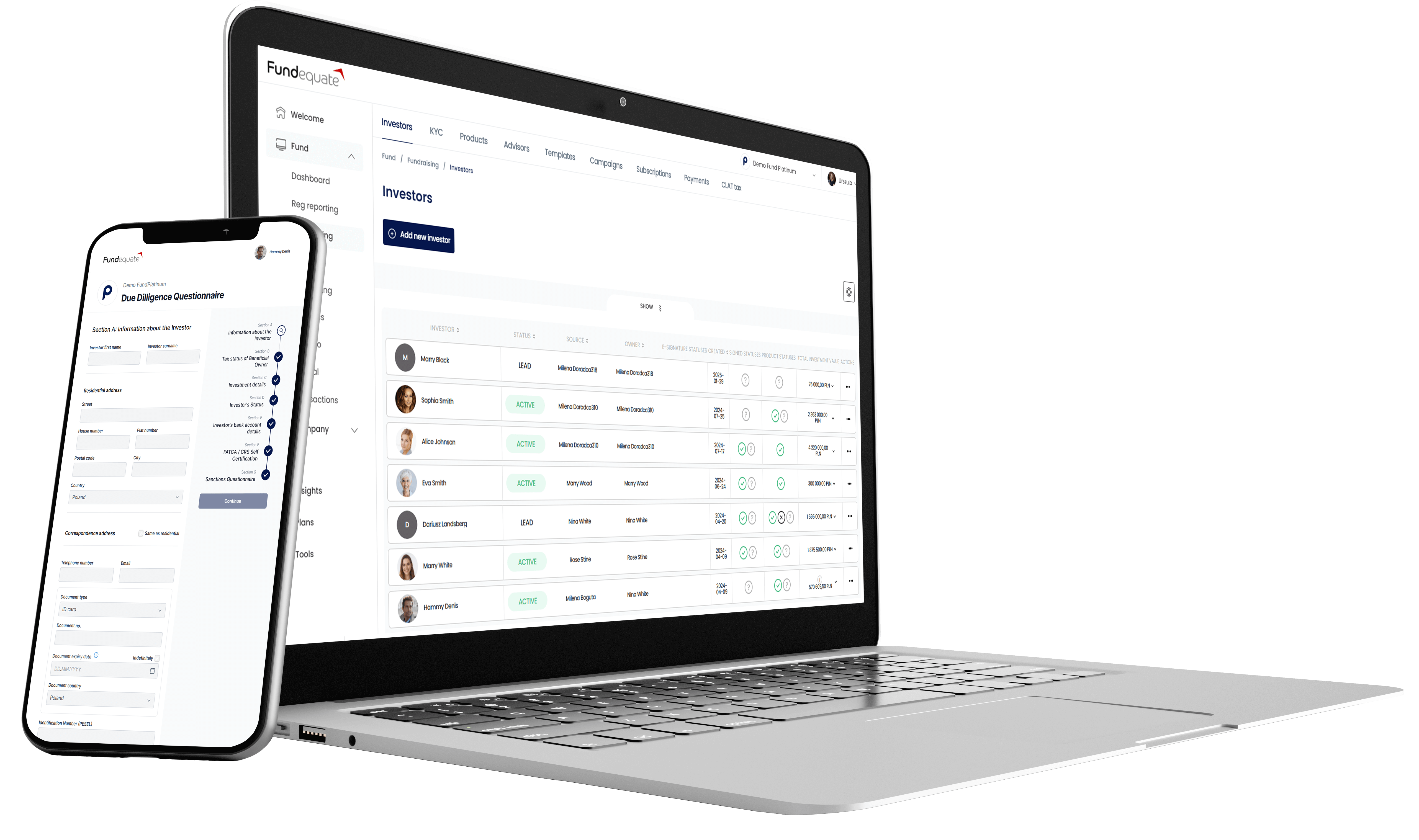

An investor portal integrated with the fund's or issuer's website, together with investor and adviser dashboards allowing for investor onboarding, AML and KYC and sales network management.

A tax-neutral syndicate based on the Luxembourg company SCSp. Online syndicate creator with onboarding of investors, substance, service and representation of directors in Luxembourg.

Investment Syndicate capital accounting, share subscriptions, allocations, portfolio records, valuations, and management fees, all streamlined by AI. Analytics and insights are available online.

Reporting of VC/PE fund performance to investors and portfolio companies to the fund with extensive analytics. Online access to full analytics, books and report builder.

We know how complex the decision path can be when you are planning a new investment vehicle. We know all about alternative funds and are happy to help you through the process.

An investment syndicate is a group of investors who pool their capital to invest in private market deals, typically led by a syndicate lead who manages the investment and handles administration.

The SCSp (Special Limited Partnership) in Luxembourg is a flexible, tax-transparent structure offering regulatory efficiency, particularly beneficial for European and international syndicates due to its compliance with EU standards.

Fundequate offers tools for structuring, onboarding, reporting, and compliance, simplifying the syndicate’s lifecycle and providing expertise in Luxembourg’s regulatory and tax frameworks.

Typically, the syndicate setup involves defining the SCSp structure, registering the partnership, drafting the Limited Partnership Agreement (LPA), appointing a General Partner (GP), and completing regulatory filings.

An SCSp comprises limited partners (LPs) whose liability is limited to their capital contributions and a general partner (GP) who holds unlimited liability but often has legal safeguards in place.

The SCSp must adhere to Luxembourg’s AML/KYC, tax, and financial reporting standards, and depending on its activities, may need to comply with AIFMD (Alternative Investment Fund Managers Directive) regulations.

Fundequate’s platform streamlines onboarding with automated KYC/AML processes, document management, and investor accreditation verification to ensure compliance with regulatory requirements.

Typically, syndicates distribute profits based on capital contributions, with the syndicate lead receiving a management fee and sometimes a share of the profits (carried interest) based on agreed terms.

Common exit strategies include asset sales, IPOs, or secondary sales of investment stakes, with Fundequate supporting documentation, tax compliance, and distribution of returns at the exit phase.

Schedule demo and find out how Fundequate can support your investment management business.