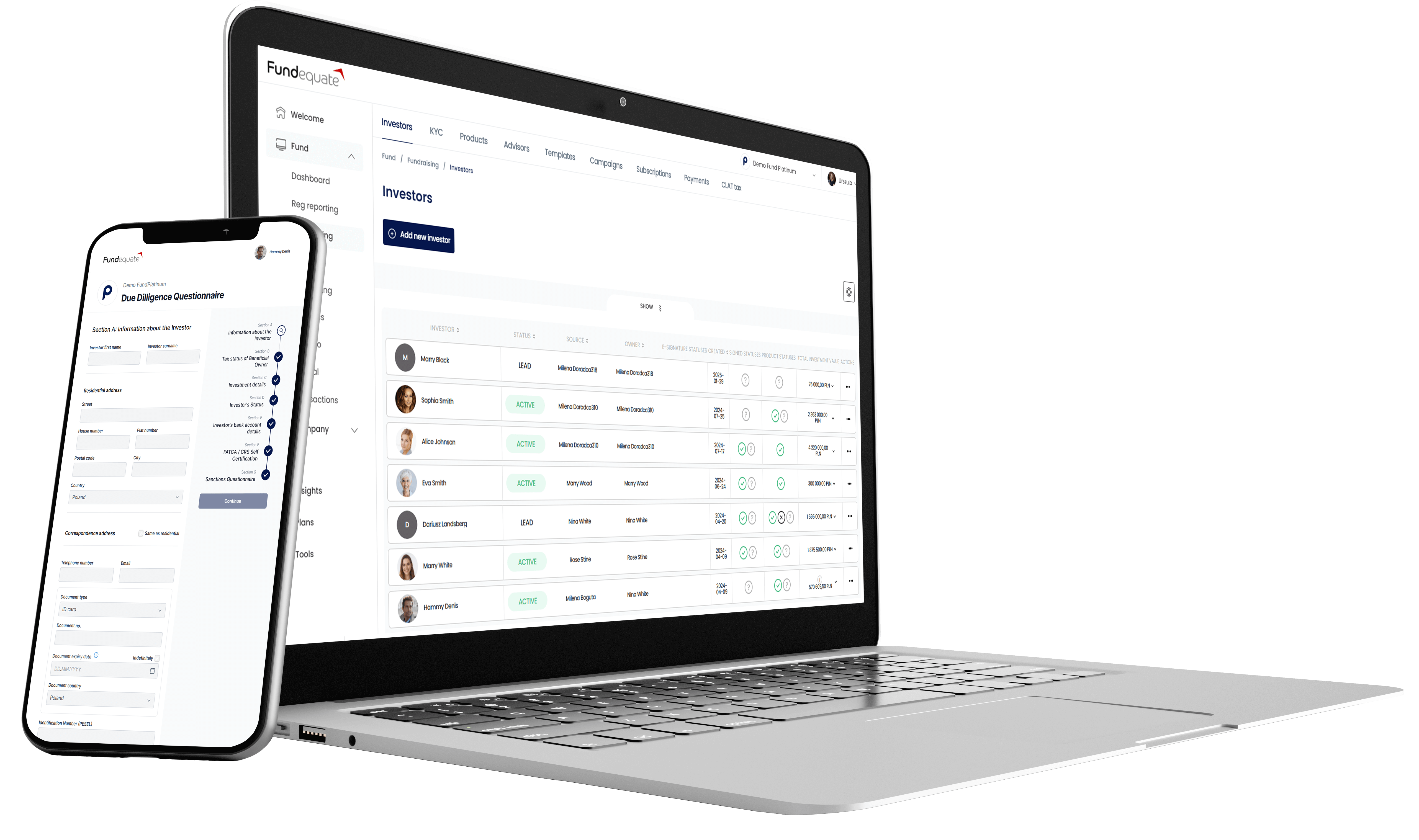

Fundequate offers comprehensive support in the establishment, administration and settlement of investment syndicates based on the Luxembourg SCSp (Société en Commandite Spéciale) structure, which provides full tax transparency for Polish investors. SCSp is a structure that enables efficient capital management thanks to its flexible approach to operating rules, suitable for venture capital funds, private equity funds and investment syndicates. Our tool supports the processes of onboarding, investment monitoring, management of capital distribution, and provides automatic reporting and settlement in compliance with regulatory requirements in both Poland and Luxembourg. Using our platform, investors can efficiently achieve their investment goals, confident that all management and settlement processes are transparent, fast and compliant with local regulations.

We know how complex the decision path can be when you are planning a new investment business. We know all about alternative funds and SCSp companies, and we’re happy to help you through the process.

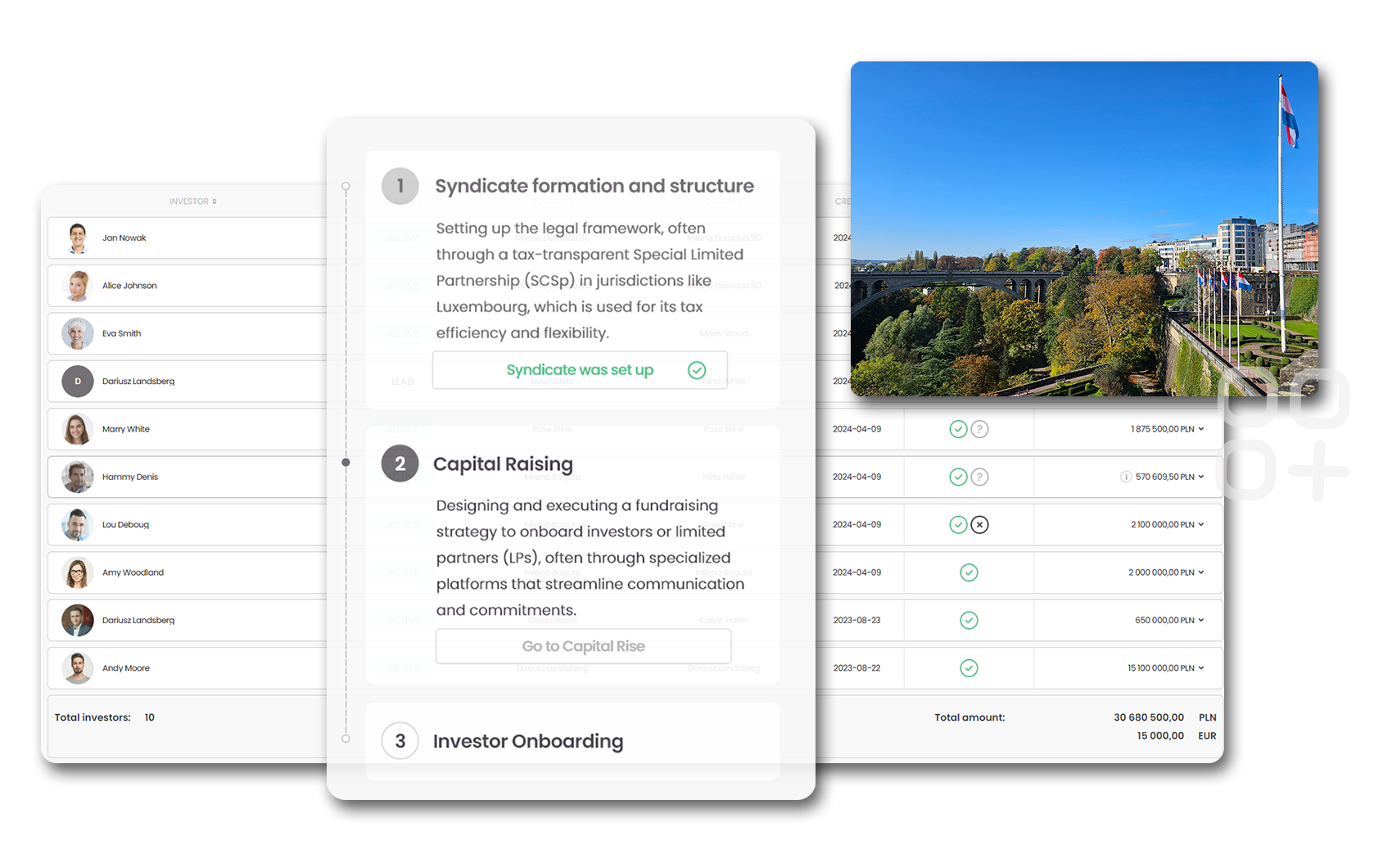

An investment syndicate is a group of investors (e.g., business angels) working together to jointly fund projects, where the leader manages the structure and makes key decisions. Fundequate offers a fully integrated setup and management model for an investment syndicate based on a tax transparent SCSp in Luxembourg.

The syndicate allows investors to spread risk, share costs and benefit from the knowledge and experience of the leader and other members.

Luxembourg’s SCSp offers tax transparency and management flexibility, while not being taxed at the structure level, making it attractive to Polish investors?

The registration process includes setting up SCSp, selecting a manager, determining the investment strategy and fee structure. All formalities can be carried out remotely with the support of the platform.

The syndicate may charge various fees, such as a management fee (for the syndicate leader), joining fees, and any fees associated with the administrative platform.

Typically, investors must meet minimum investment thresholds, as well as confirm status as a professional or qualified investor to meet regulatory requirements.

Decisions are made by the syndicate leader, often in consultation with a group of investors. The leader is responsible for selecting projects and negotiating investment terms.

SCSp syndicates must provide regular reports to investors, including investment performance, repayment schedules and current tax obligations.

Yes, but exiting before completion may require selling shares to another investor or getting approval from the syndicate leader.

Fundequate’s platform offers tools for investment monitoring, investor onboarding, reporting, and integration with accounting systems to facilitate syndication operations and settlements.

Schedule demo and find out how Fundequate can support your investment management business.