Alternative Investment Funds (AIFs), or alternative funds, offer investors the opportunity to allocate capital in assets other than classic investment funds. Setting up such a fund, especially in Poland or Luxembourg, involves many legal, regulatory and operational requirements. Here are the key steps and information that will help you understand the process of setting up an alternative fund from the perspective of the Fundequate platform.

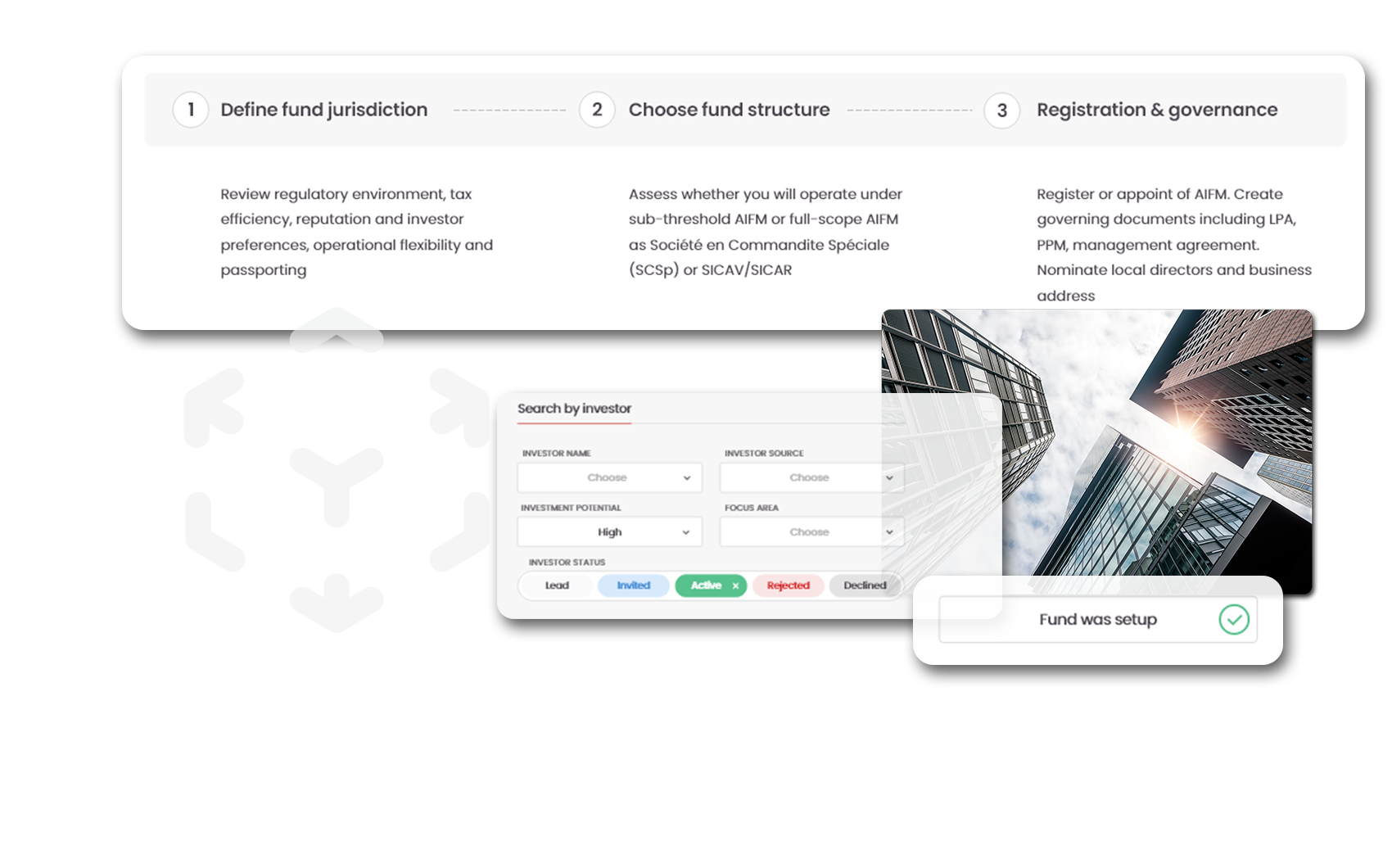

1. Choice of Jurisdiction: Poland or Luxembourg?

Polska i Luksemburg to popularne lokalizacje dla zakładania AFI ze względu na ich różne podejścia regulacyjne i korzyści dla inwestorów. Luksemburg, jako centrum finansowe UE, oferuje przejrzyste struktury regulacyjne i silną ochronę prawną, co przyciąga międzynarodowych inwestorów. Polska natomiast, dzięki lokalnym uwarunkowaniom, może być bardziej korzystna dla rodzimych inwestorów, szczególnie w zakresie kosztów i dostępności zasobów.

2. Choice of fund structure

The choice of structure is crucial and depends on the nature of the investment and the planned management. Alternative funds can be run as:

3. Registration of the fund and obtaining authorisation from the supervisory authority

In Poland, fund registration takes place through the Polish Financial Supervision Authority (KNF) and the requirements for alternative fund registration in Luxembourg are handled by the CSSF. In each case, documentation is required to confirm the qualifications of the managers and the compliance of the structure with the regulatory requirements.

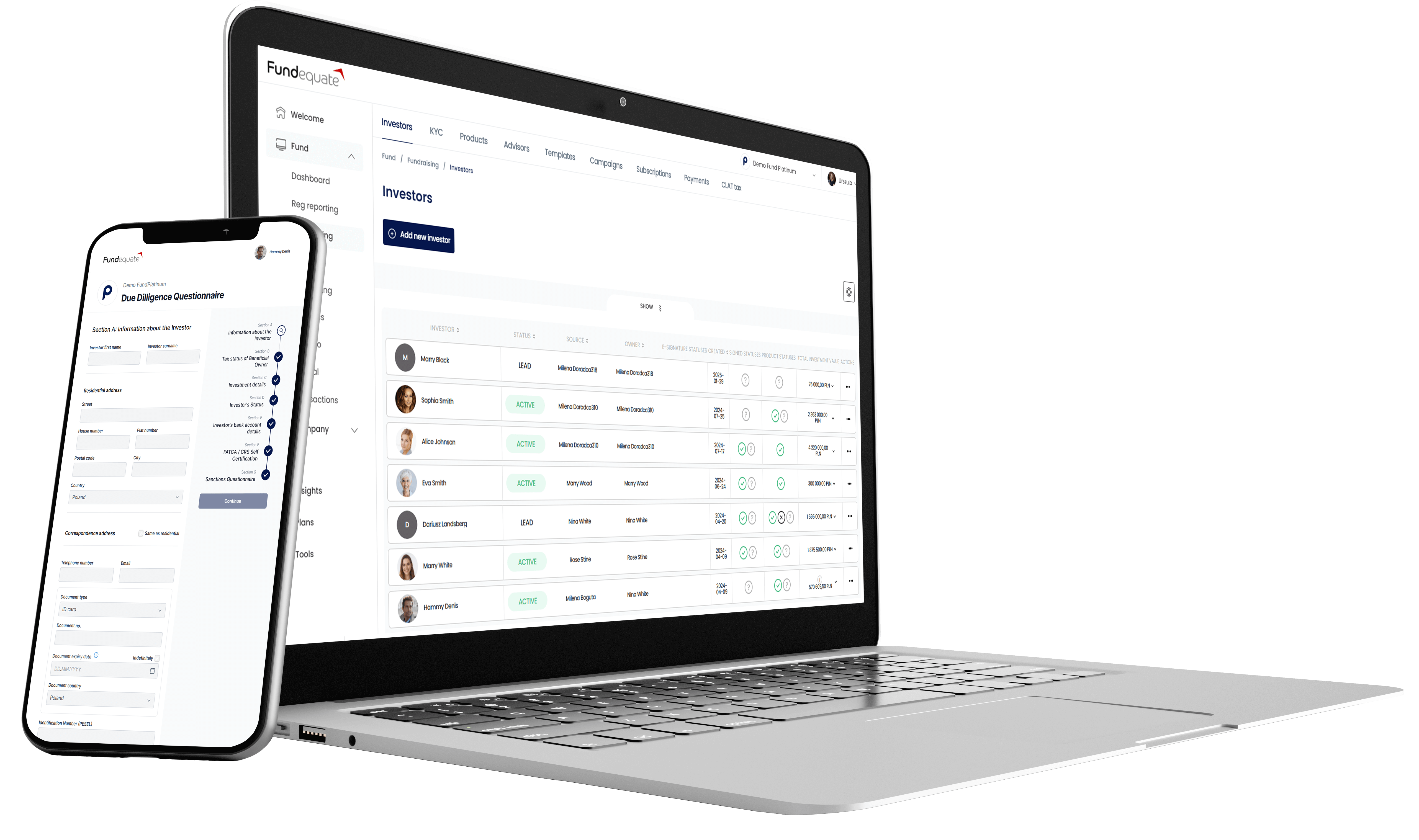

4. Fundequate services: administration and support of the fund

Fundequate zapewnia kompleksową platformę do zarządzania funduszami alternatywnymi, obejmującą rejestrację, raportowanie, onboarding inwestorów oraz zgodność z przepisami w zakresie zarządzania funduszami w obu jurysdykcjach. Nasza platforma umożliwia:

5. Bookkeeping and reporting

Accounting and reporting are key to maintaining regulatory compliance. Both Poland and Luxembourg require compliance with strict accounting standards and regular reporting to the relevant supervisory authorities. Fundequate’s platform ensures easy reporting through integration with accounting systems and automatic report generation.

6. Investment monitoring and onboarding of investors

Effective management and transparency to investors are crucial to the success of an alternative fund. With our platform, investors have access to full financial and analytical reports, as well as risk assessment tools. The investor onboarding process is simplified with integrated features that automate investor acceptance and management of their data.

7. Advantages of using Fundequate

Our platform simplifies the process of alternative fund management with modular solutions that can be customised to meet the specific needs of a particular fund. Fundequate provides:

Fundequate is a comprehensive solution for investors and fund managers to operate effectively in both Poland and Luxembourg. Let us support your alternative fund from the very first step. Contact us to find out more!

We know how complex the decision path can be when you are planning a new fund. We know all about alternative funds and are happy to help you through the process.

Alternative Investment Fund enjoy exemption from capital gains tax if the requirements set out in the CIT Act are met – that is, the AIF has held continuously for a period of min. 2 years of holding a share in the capital of a given investment at a level of not less than 5%. If this condition is not met by the AIF, the profit from the disposal of the investment is subject to 19% CIT.

The cost of accounting for an Alternative Investment Fund depends on several factors. The most important of these are the type of fund and the number of transactions executed by it, the number and frequency of investor entries/exits, the frequency of valuations, the extent of management reporting requirements and the complexity of the investment portfolio. Fundequate, together with Genprox, as reputable players on the Polish market, offer their clients comprehensive coverage of accounting, tax settlement, regulatory reporting to the FSA, financial statements and investor settlement. Such services start at approximately PLN 4,500 net per month.

Keeping the accounts of an Alternative Investment Fund requires knowledge not only of the principles of the Accounting Act but also of the regulation on the valuation and presentation of financial instruments, including the principles of valuation of AIF financial assets. In order to conduct AIF accounting comprehensively and safely, it is necessary to be perfectly familiar with the tax regulations applicable to AIF and its investors in the case of distribution of profits from a VC fund.

A VC fund operating as an Alternative Investment Fund is taxed with a capital gains tax of 19%. However, the CIT Act provides for an exemption for AIFs certain requirements set out in the provision are met. These are that the AIF holds investments continuously for a period of two years and at a level of not less than 5% of the capital in the portfolio company concerned.

AIF management activities are exempt from VAT pursuant to Article 43(1)(12) of the VAT Act. However, in the case of the provision of ancillary services for consideration to AIF’s portfolio companies or other entities involved in AIF’s main activities (e.g. co-investors), it will be necessary to issue VAT invoices, which will involve the AIFM or AIF registering for VAT as an active VAT taxpayer. In the case of AIFM, which re-invoices AIF for the management fee at exempt rate, the provision of additional services at 23% rate will complicate the settlement model as it will force the so-called VAT proportion.

No, AIF is not required to be registered for VAT and, in principle, most AIFMD and AIFs are not active VAT payers. However, both AIFMs and AIFs can be registered for VAT.

Yes, AIFs as well as AIFMs in the case of externally managed AIFs are entities operating under the provisions of the Funds Act, and these in the Accounting Act are obliged to have their financial statements audited by a statutory auditor, irrespective of the value of assets, the amount of revenue and the level of employment.

No, an AIF under the management of a AIFM operating on the basis of an entry in the Polish FSA register is not required to have external portfolio valuations. However, the practice we observe is that increasingly auditors are seeking to force such external valuations on AIFs as this reduces their audit risk.

An AIF is a form of co-investment provided for by the provisions of the Funds Act, which involves raising funds from a number of investors to invest them with a set risk profile according to a specific investment policy adopted by the manager of the alternative investment company.

The first step is to determine the form of the AIF’s business and the method of management – there are two options to choose from: An externally managed AIF (by a separate management company) or an internally managed AIF (which performs the management function itself). When choosing a management model, it is important to consider not only the organisational structure of the AIF, but also operating costs, the planned investment model and investor preferences. In the case of an externally managed AIF, the key role is played by the management company, which fulfils the regulatory requirements and makes the day-to-day investment decisions. An internally managed AIF, on the other hand, performs the function of both the fund and the manager, which entails greater autonomy but requires a higher level of internal organisation and more investment policy development.

Read more about AIF registration at: https://genprox.com/blog/jak-zalozyc-asi-alternatywna-spolke-inwestycyjna/

Establishing an Alternative Investment Fund involves registering it with the Polish FSA and the National Court Register. Read more about the registration process at: https://genprox.com/blog/jak-zalozyc-asi-alternatywna-spolke-inwestycyjna/

Accounting for an Alternative Investment Funds requires knowledge and experience in the investment industry. Genprox and Fundequate is the best accounting firm for AIF accounting. We handle more than 70% of the value of ASI assets in Poland and serve such renowned funds as PFR Ventures operating as fund-of-funds, Vinci ASI, Pracuj VC, Movens, Smok and many others.

Schedule demo and find out how Fundequate can support your investment management business.