How to manage the accounting for AIFs and how to settle AIF taxes are the main questions that AIF managers ask themselves after registering the fund with the KNF. Genprox and Fundequate have been providing unmatched expertise, experience, and understanding of the investment industry for six years, setting standards in the VC market in Poland. A Venture Capital fund or another investment vehicle registered as an Alternative Investment Fund (AIF) is subject to the Accounting Act as well as the regulation of the Minister of Finance concerning specific principles for recognition, valuation methods, disclosure scope, and presentation of financial instruments.

In addition to the financial reporting requirements, AIFs are also subject to regulatory reporting obligations. The accounting for AIFs must ensure that the analytics of event records concerning the equity and portfolio of the AIF enable the AIF manager to prepare and submit DATMAN and DATAIF reports to the KNF. Therefore, Genprox, as the leading service provider for AIFs in Poland, has created the Fundequate platform, which allows for the recording of equity and the AIF portfolio and automates the generation of mandatory reports for the KNF.

Key Considerations for Accounting in Alternative Investment Companies (AIFs):

We support all types of Alternative Investment Funds (AIFs) in Poland, from private passive structures and PFR Ventures funds to licensed AIFs and trading platforms.

We provide comprehensive support for private investment vehicles in the form of Alternative Investment Funds (AIFs), designed to facilitate the contribution of financial assets by affluent individual clients. These AIFs emerged as an alternative during the absence of regulations concerning family foundations and continue to offer a high degree of predictability in the context of changing legal provisions related to wealth management. In light of the still unclear plans of the Ministry of Finance regarding family foundations, AIFs offer a stable and secure solution for investors.

We service most of the significant private venture capital (VC) funds in Poland that operate as Alternative Investment Funds (AIFs). Such structures typically limit themselves to a small group of investors, which fosters a personalized approach and better alignment of investment strategies. However, there are also funds that engage several dozen limited partners (LPs), allowing for increased investment capital and the execution of larger projects.

Our clients also include the most important public funds, including Vinci AIF and PFR Ventures AIF, which, as part of the FENG program, will operate as fund-of-funds investing in AIFs under the FENG Starter, Biznest, Open Innovations, Koffi, and CVC programs.

As the only entity on the market and a service provider for AIFs with unmatched experience in servicing AIFs, we also support trading platforms operating in the form of AIFs, providing integration with platforms like Interactive Brokers and AIF ledgers, giving AIF investors online access to the Investor Panel.

Genprox, using the Fundequate platform, is the only entity that has gained the trust of PFR Ventures and services the licensed AIFs of PFR Ventures, which will be used for the distribution of funds in the FENG program.

Our expertise and experience in the investment fund market also enable us to provide comprehensive services for Investment Fund Managers.

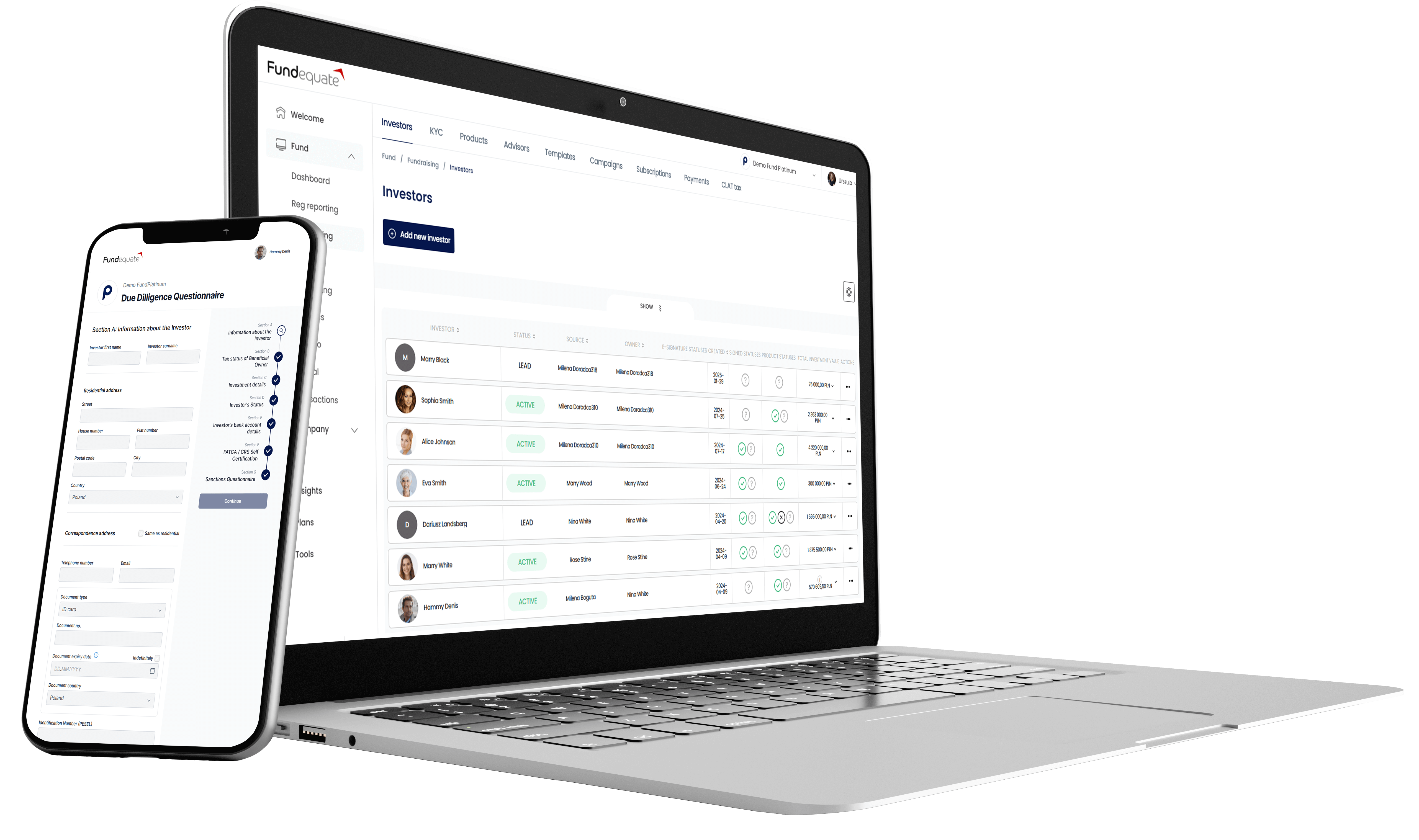

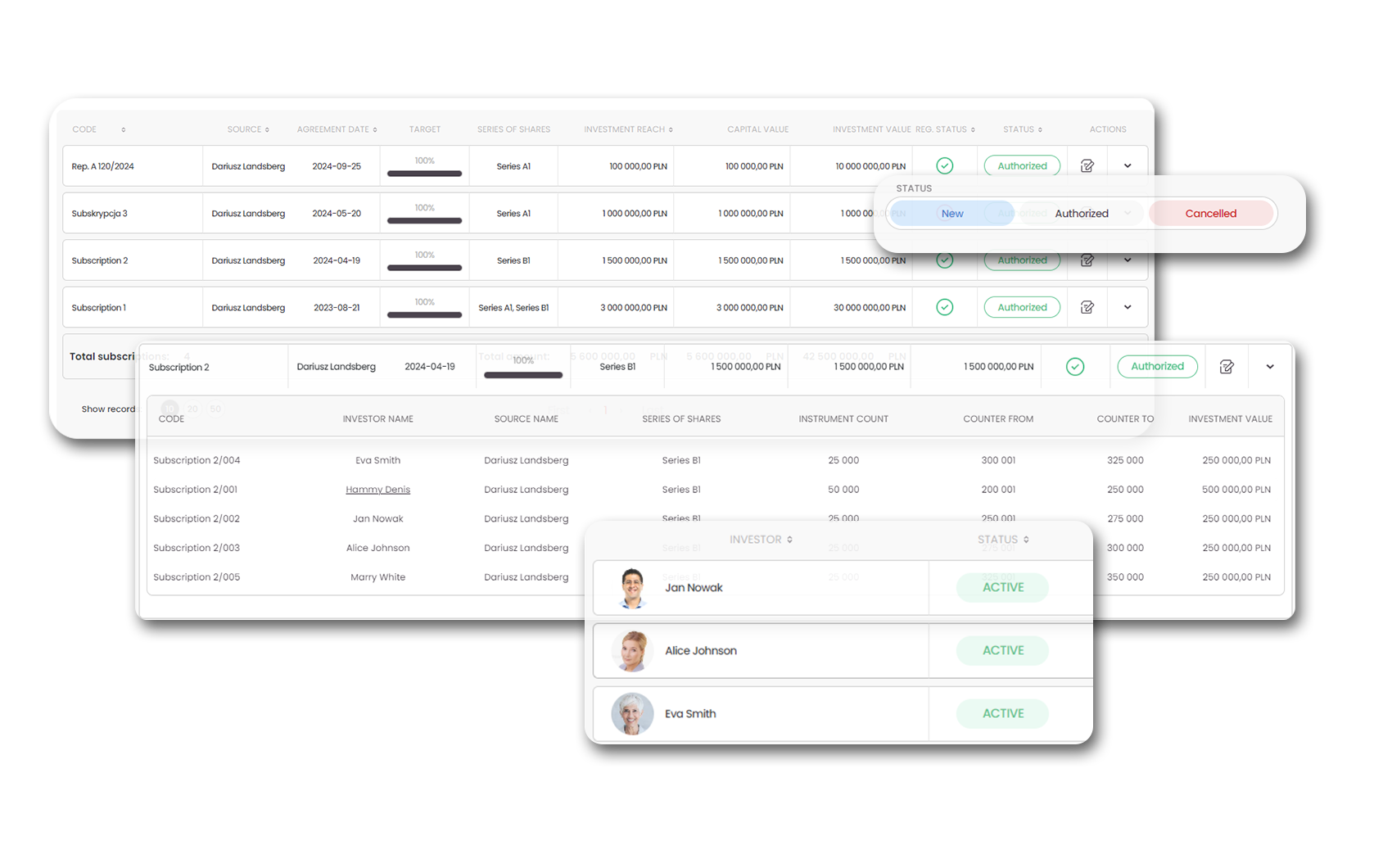

The Fundraising module of our platform provides complete capital recording for the fund, along with the settlement of each subscription and the allocation of shares to the fund’s investors.

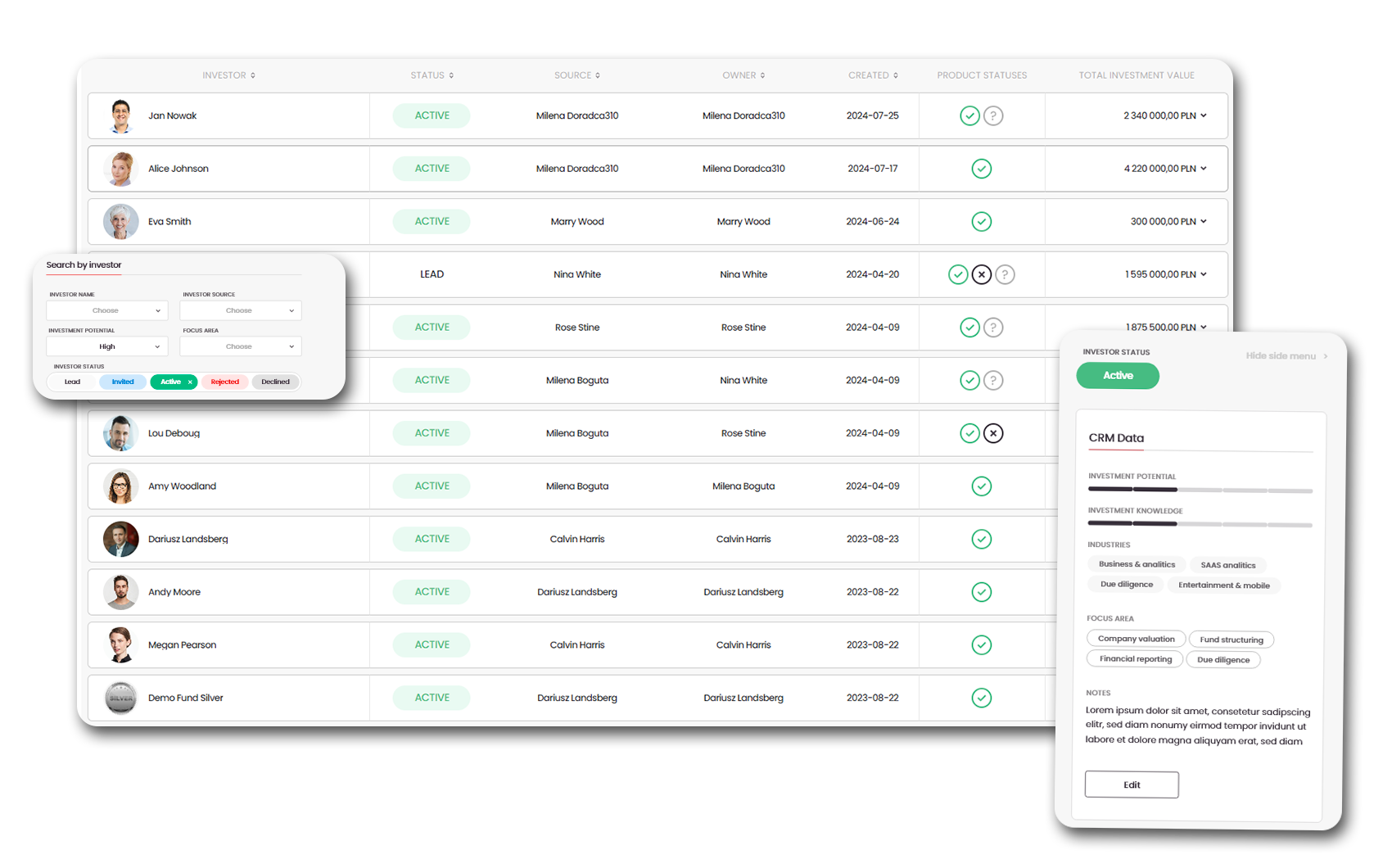

Outreach campaigns to potential VC fund investors with the ability to declare interest in investment and a full investor onboarding model, including AML verification, are standard at Fundequate.

The Investor Panel allows access to the fund’s investments and reporting without the need for investor emails, PDF documents and paper documentation. Everything online, in real time and, above all, under the fund’s control and fully recorded for regulator scrutiny.

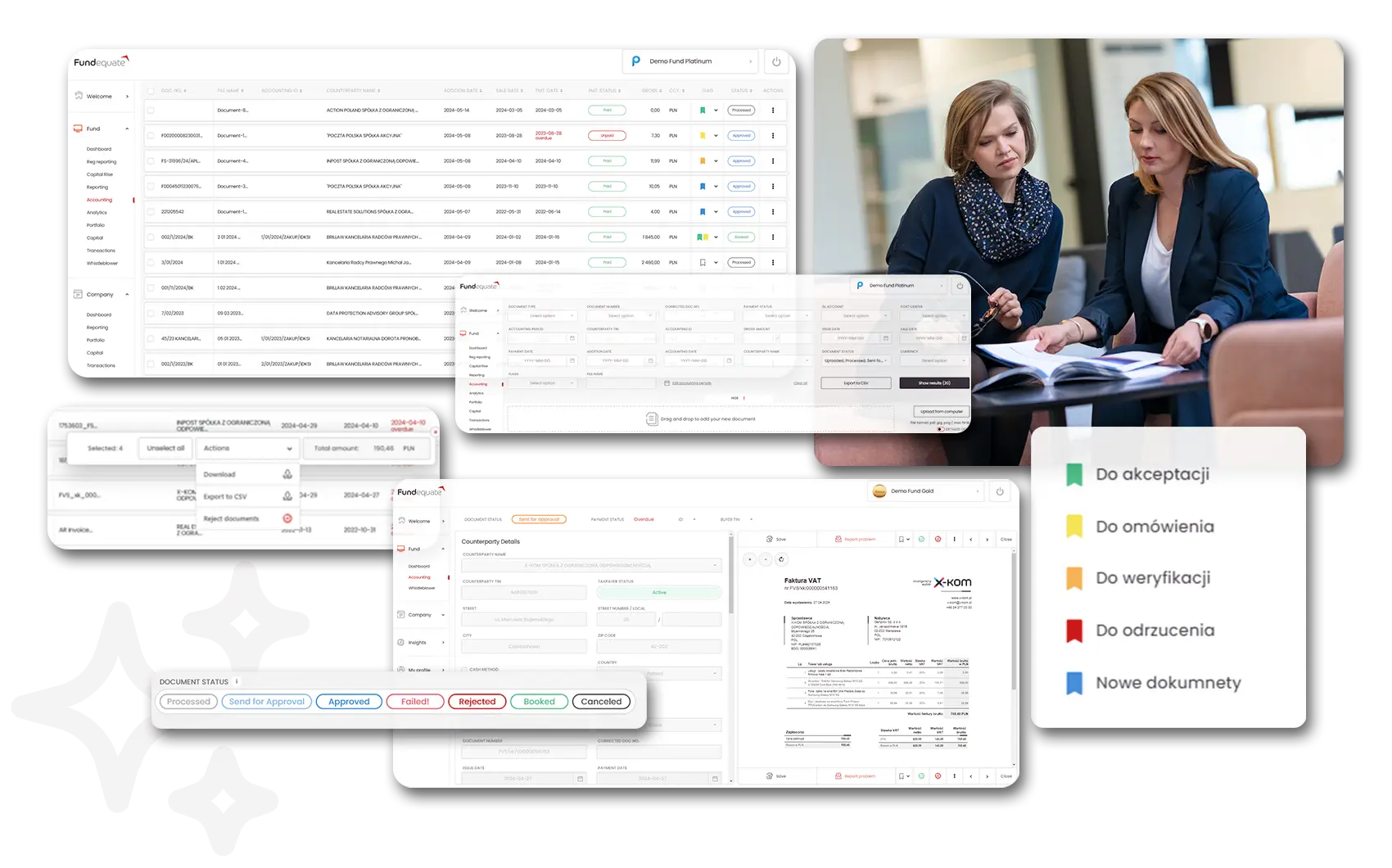

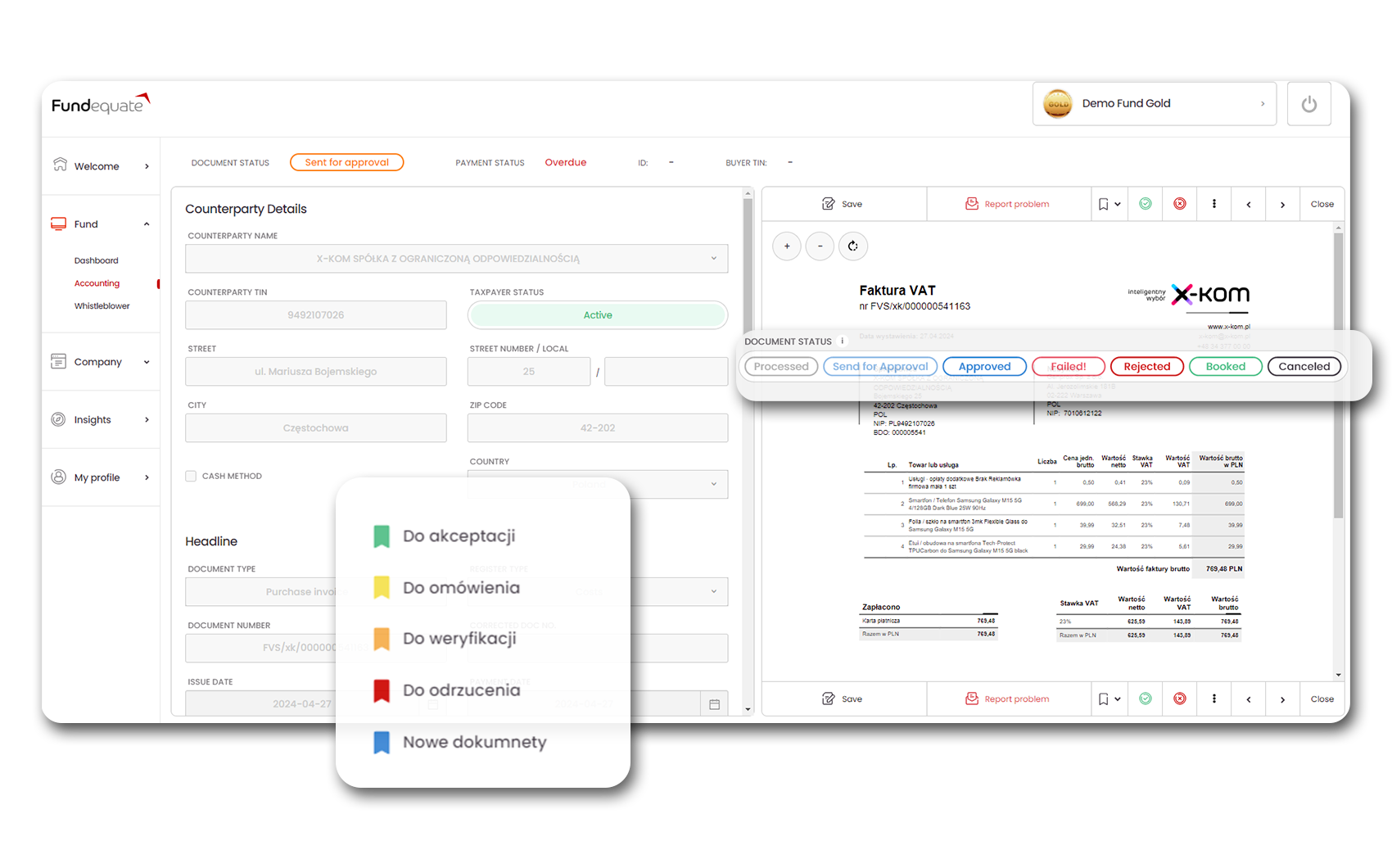

Our clients have access to Fundequate online allowing them to add accounting documents to the OCR system, which reads the documents in real time, and the AI model we have implemented pre-interprets these documents assigning an accounting account. Regardless, our experienced accountants keep their hand in and verify the entire process.

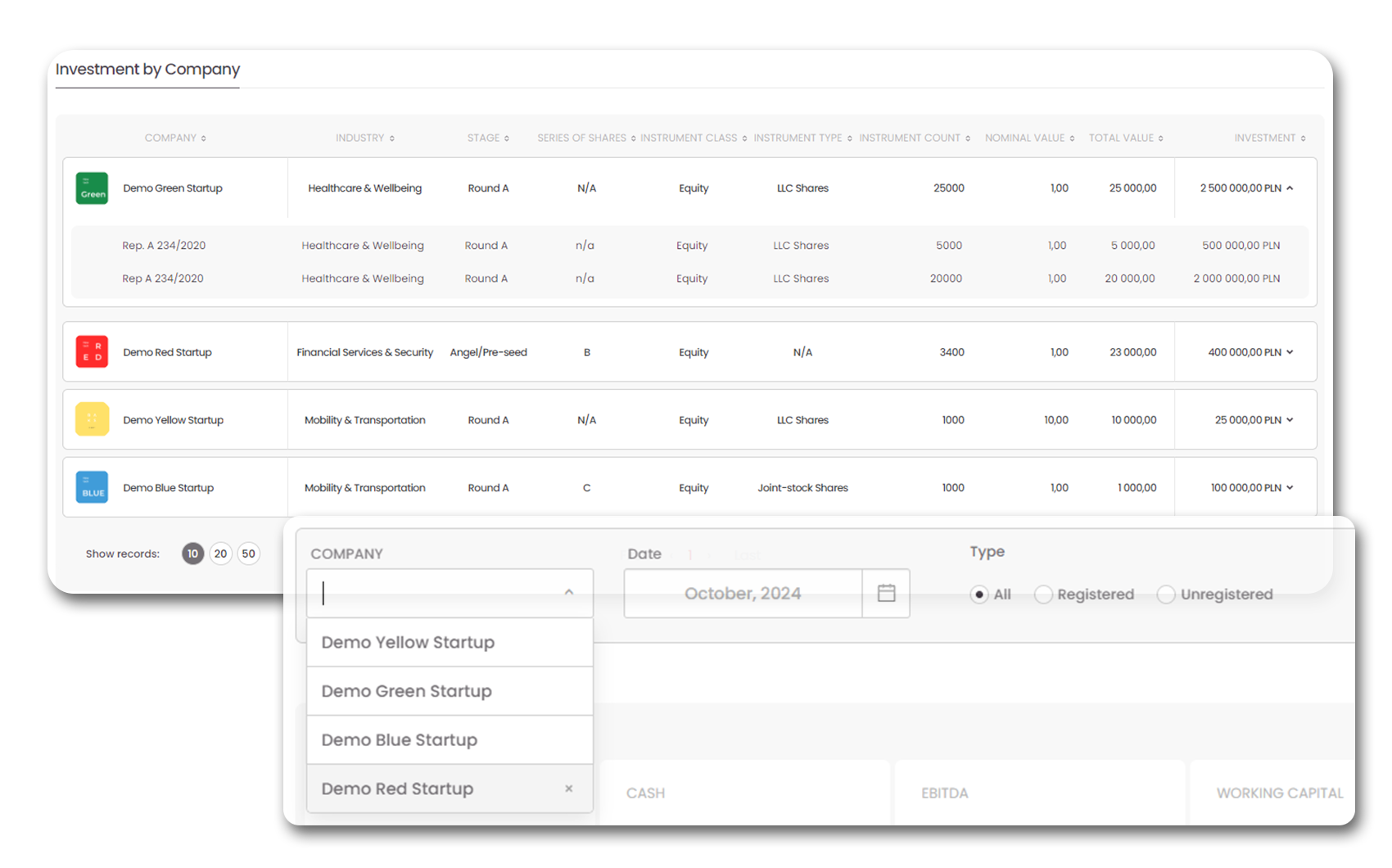

Each of the fund’s investments is recorded in the Fundequate Portfolio module, which allows to maintain full analytics for the fund’s portfolio along with quantitative records. This, combined with the VC fund’s portfolio revaluation model, provides a tool to keep fund managers in full control of the investment portfolio.

The Fundequate platform is fully integrated with the accounting system on which we serve our clients. Fund mangers therefore have online access to fund data. Analytics in any format, periodic reports and statements are available in real time as standard for our accounting service.

Thanks to the Fundequate platform, combined with the experience of our accountants and financial controllers, we offer an accounting service for AIFM/AIF that is unparalleled in the Polish market, with full support for tax settlement in AIF, preparation of AIF financial statements and settlement of VC fund investors.

We specialize in servicing AIFs and have been providing comprehensive support to Alternative Investment Companies for the past 6 years, and together with reputable law firms, tax advisors and auditors, we have created standards for servicing AIFs in the areas of finance, accounting, taxation and financial and regulatory reporting.

Accountants specialized in handling VC funds in the form of AIF combined with our Fundequate platform is a unique combination providing the highest level of service and the only such standard for running a VC fund in Poland. AIF capital and portfolio accounting, investor onboarding & AML, share allocation and accounting with OCR support AI.

We know how complex the decision path can be when you are planning a new fund. We know all about alternative funds, their registration, accounting model configuration, reporting and taxes, and we’re happy to help you through the process.

Alternative Investment Fund enjoy exemption from capital gains tax if the requirements set out in the CIT Act are met – that is, the AIF has held continuously for a period of min. 2 years of holding a share in the capital of a given investment at a level of not less than 5%. If this condition is not met by the AIF, the profit from the disposal of the investment is subject to 19% CIT.

The cost of accounting for an Alternative Investment Company depends on several factors. The most important of these are the type of fund and the number of transactions executed by it, the number and frequency of investor entries/exits, the frequency of valuations, the extent of management reporting requirements and the complexity of the investment portfolio. Fundequate, together with Genprox, as reputable players in the Polish market, offer their clients comprehensive coverage of accounting, tax settlement, regulatory reporting to the FSA, financial statements and investor settlement. Such services start at about PLN 4,500 net per month.

Keeping the accounts of an Alternative Investment Fund requires knowledge not only of the principles of the Accounting Act but also of the regulation on the valuation and presentation of financial instruments, including the principles of valuation of AIF financial assets. In order to conduct AIF accounting comprehensively and safely, it is necessary to be perfectly familiar with the tax regulations applicable to AIF and its investors in the case of distribution of profits from a VC fund.

A VC fund operating as an Alternative Investment Fund is taxed with a capital gains tax of 19%. However, the CIT Act provides for an exemption for AIFs certain requirements set out in the provision are met. These are that the AIF holds investments continuously for a period of two years and at a level of not less than 5% of the capital in the portfolio company concerned.

AIF management activities are exempt from VAT pursuant to Article 43(1)(12) of the VAT Act. However, in the case of the provision of ancillary services for consideration to AIF’s portfolio companies or other entities involved in AIF’s main activities (e.g. co-investors), it will be necessary to issue VAT invoices, which will involve the AIFM or AIF registering for VAT as an active VAT taxpayer. In the case of AIFM, which re-invoices AIF for the management fee at exempt rate, the provision of additional services at 23% rate will complicate the settlement model as it will force the so-called VAT proportion.

No, AIF is not required to be registered for VAT and, in principle, most AIFMD and AIFs are not active VAT payers. However, both AIFMs and AIFs can be registered for VAT.

Yes, AIFs as well as AIFMs in the case of externally managed AIFs are entities operating under the provisions of the Funds Act, and these in the Accounting Act are obliged to have their financial statements audited by a statutory auditor, irrespective of the value of assets, the amount of revenue and the level of employment.

No, an AIF under the management of a AIFM operating on the basis of an entry in the Polish FSA register is not required to have external portfolio valuations. However, the practice we observe is that increasingly auditors are seeking to force such external valuations on AIFs as this reduces their audit risk.

An AIF is a form of co-investment provided for by the provisions of the Funds Act, which involves raising funds from a number of investors to invest them with a set risk profile according to a specific investment policy adopted by the manager of the alternative investment company.

The first step is to determine the form of the AIF’s business and the method of management – there are two options to choose from: An externally managed AIF (by a separate management company) or an internally managed AIF (which performs the management function itself). When choosing a management model, it is important to consider not only the organisational structure of the AIF, but also operating costs, the planned investment model and investor preferences. In the case of an externally managed AIF, the key role is played by the management company, which fulfils the regulatory requirements and makes the day-to-day investment decisions. An internally managed AIF, on the other hand, performs the function of both the fund and the manager, which entails greater autonomy but requires a higher level of internal organisation and more investment policy development.

Read more about AIF registration at: https://genprox.com/blog/jak-zalozyc-asi-alternatywna-spolke-inwestycyjna/

Establishing an Alternative Investment Fund involves registering it with the Polish FSA and the National Court Register. Read more about the registration process at: https://genprox.com/blog/jak-zalozyc-asi-alternatywna-spolke-inwestycyjna/

Accounting for an Alternative Investment Funds requires knowledge and experience in the investment industry. Genprox and Fundequate is the best accounting firm for AIF accounting. We handle more than 70% of the value of ASI assets in Poland and serve such renowned funds as PFR Ventures operating as fund-of-funds, Vinci ASI, Pracuj VC, Movens, Smok and many others.

Schedule demo and find out how Fundequate can support your investment management business.