The Fundequate module is an advanced solution that supports the loan issuance process and distribution network management by selectively assigning access to data from marketing campaigns. The automation function for generating and signing contracts, integrated with Autenti, streamlines the conclusion of transactions and increases operational efficiency. With unique access to the platform, lenders can monitor their deals in real time and manage active investments with full visibility of repayment schedules.

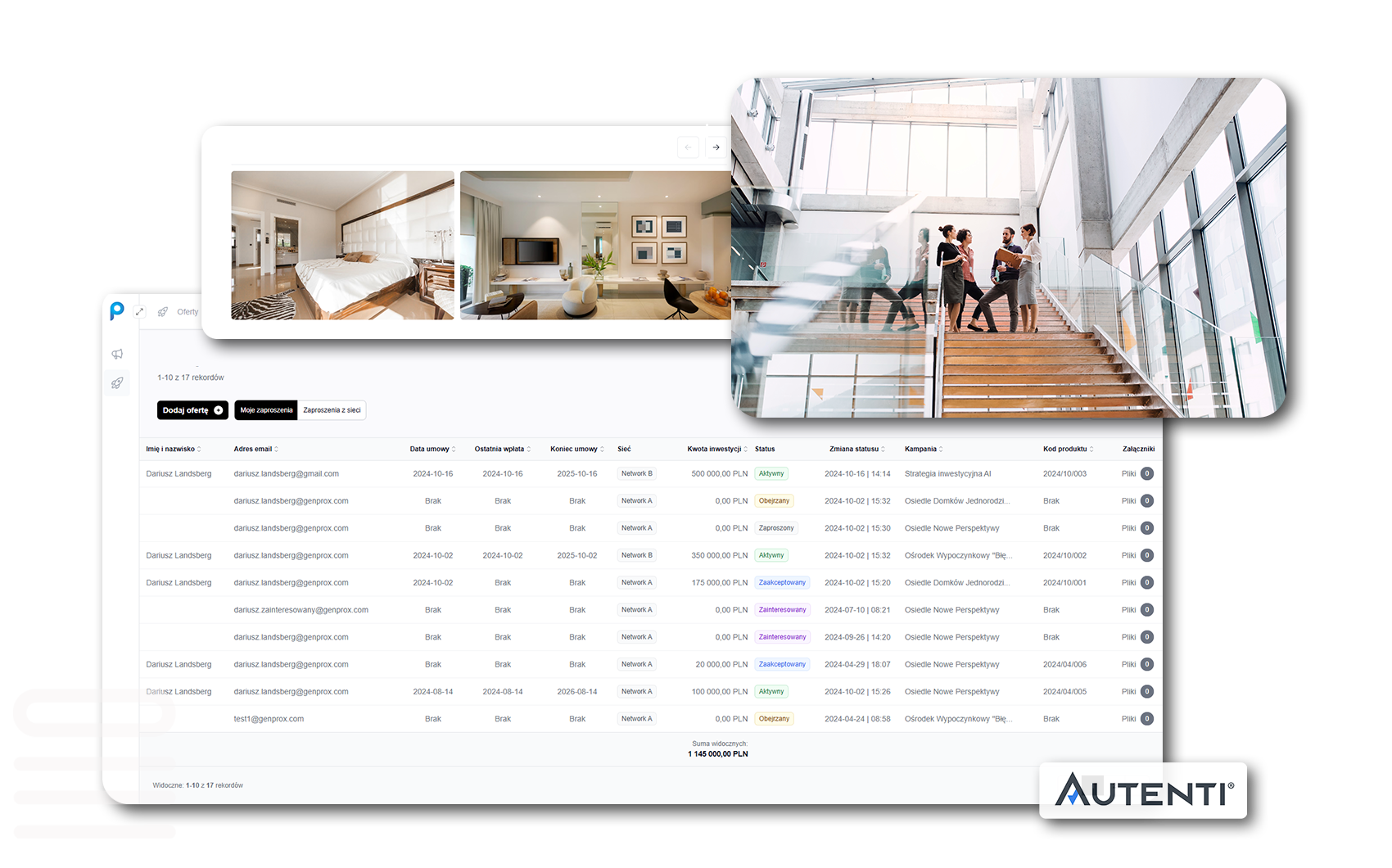

For loan issuers, Fundequate offers a module that enables the creation of investment campaigns targeted at a closed group of designated investors, leveraging an internal or external distribution network.

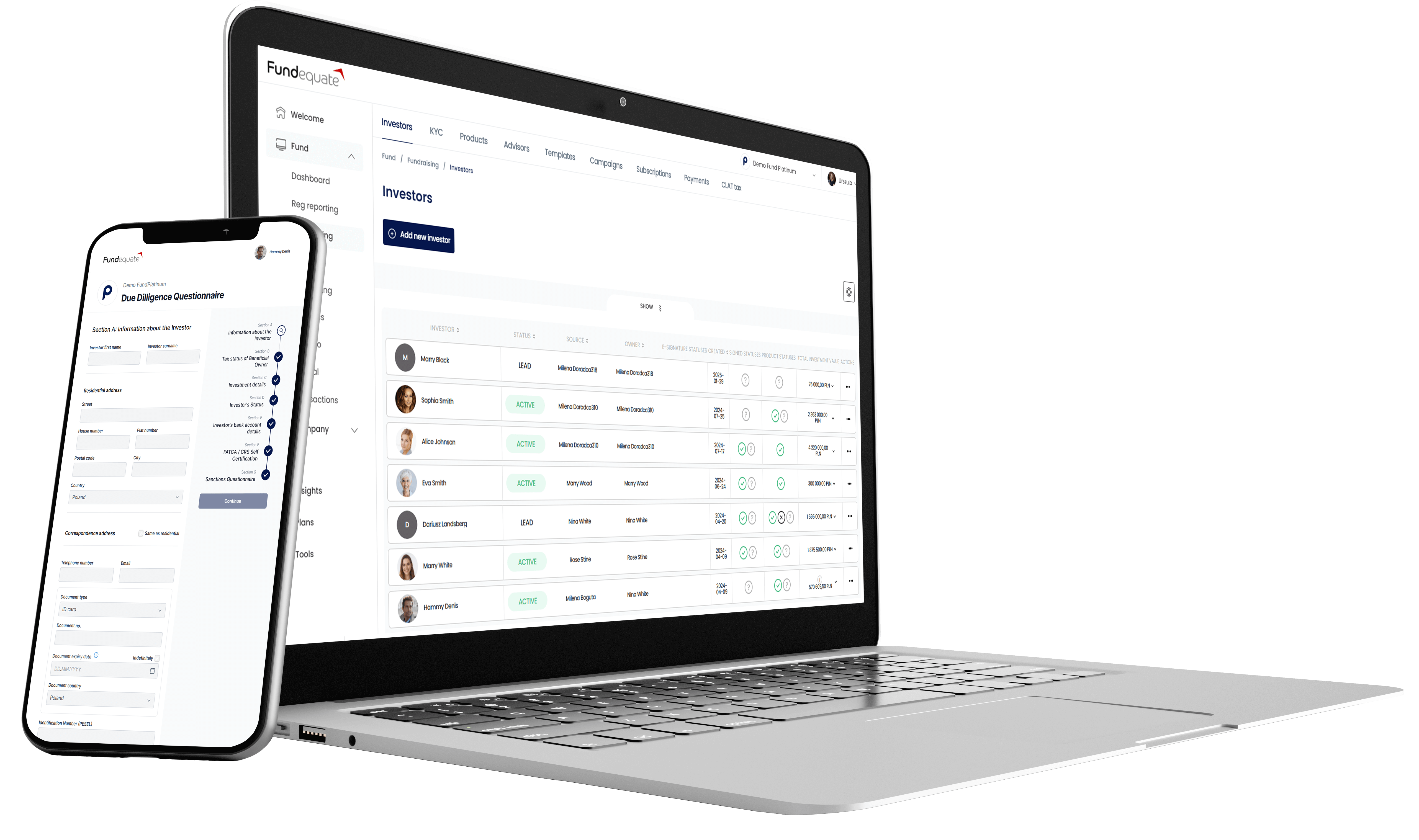

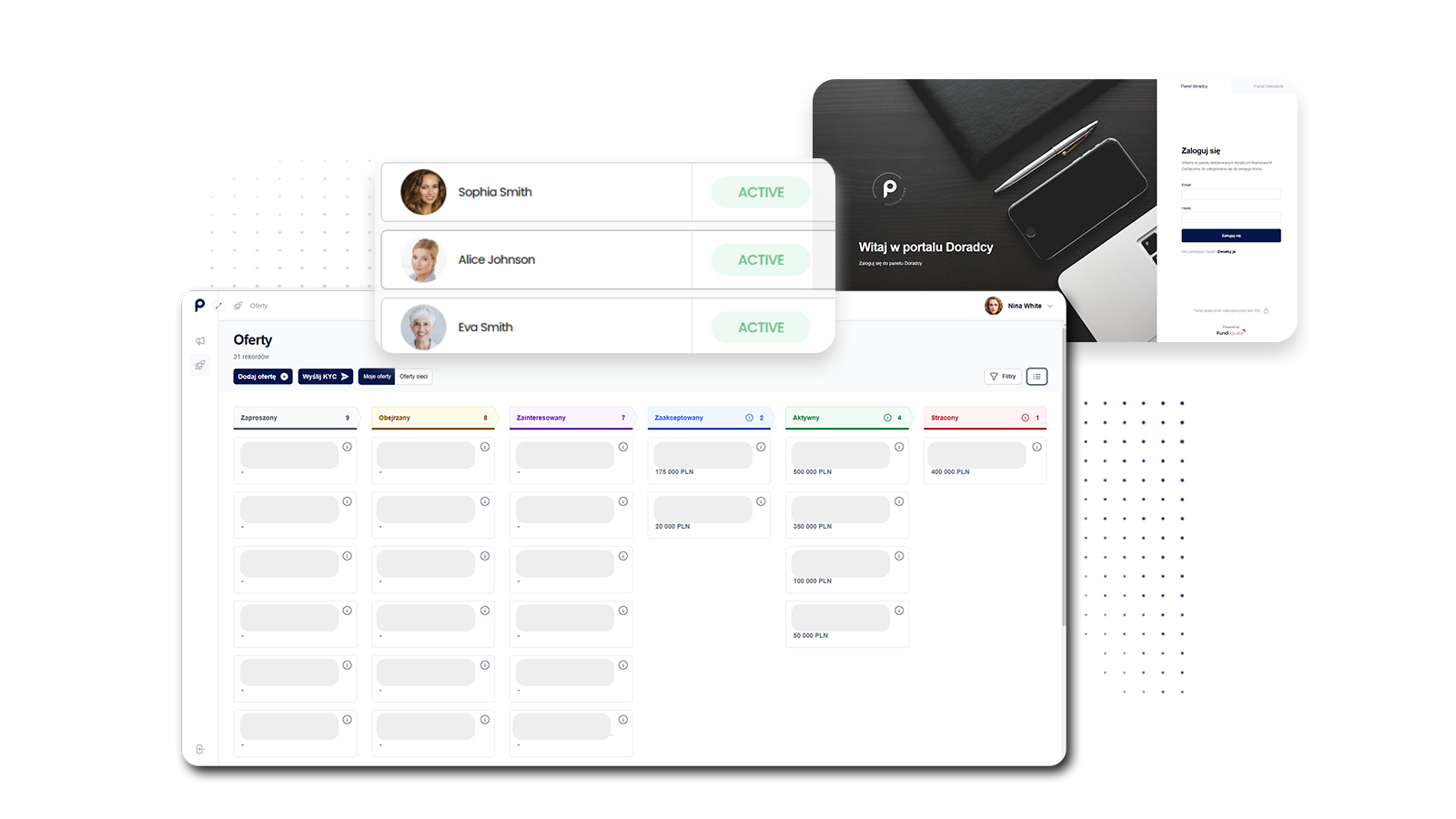

Fundequate automates lender onboarding, ensuring fast and regulatory-compliant KYC and AML processes conducted entirely electronically. API integration with Autenti and IDnow enables identity verification and counterparty status checks. The full integration of the lender onboarding process minimizes formalities while ensuring secure identity and counterparty status verification.

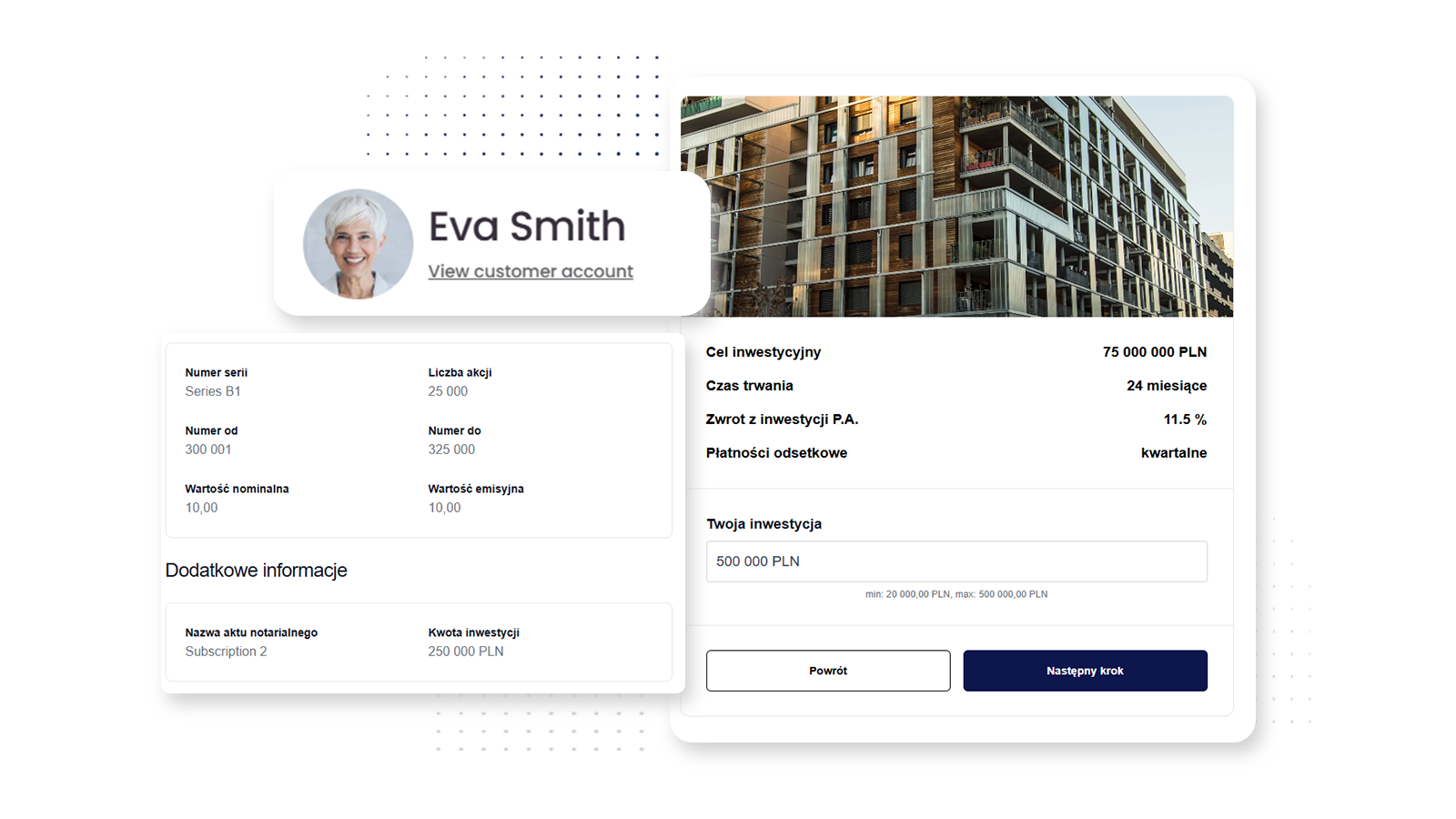

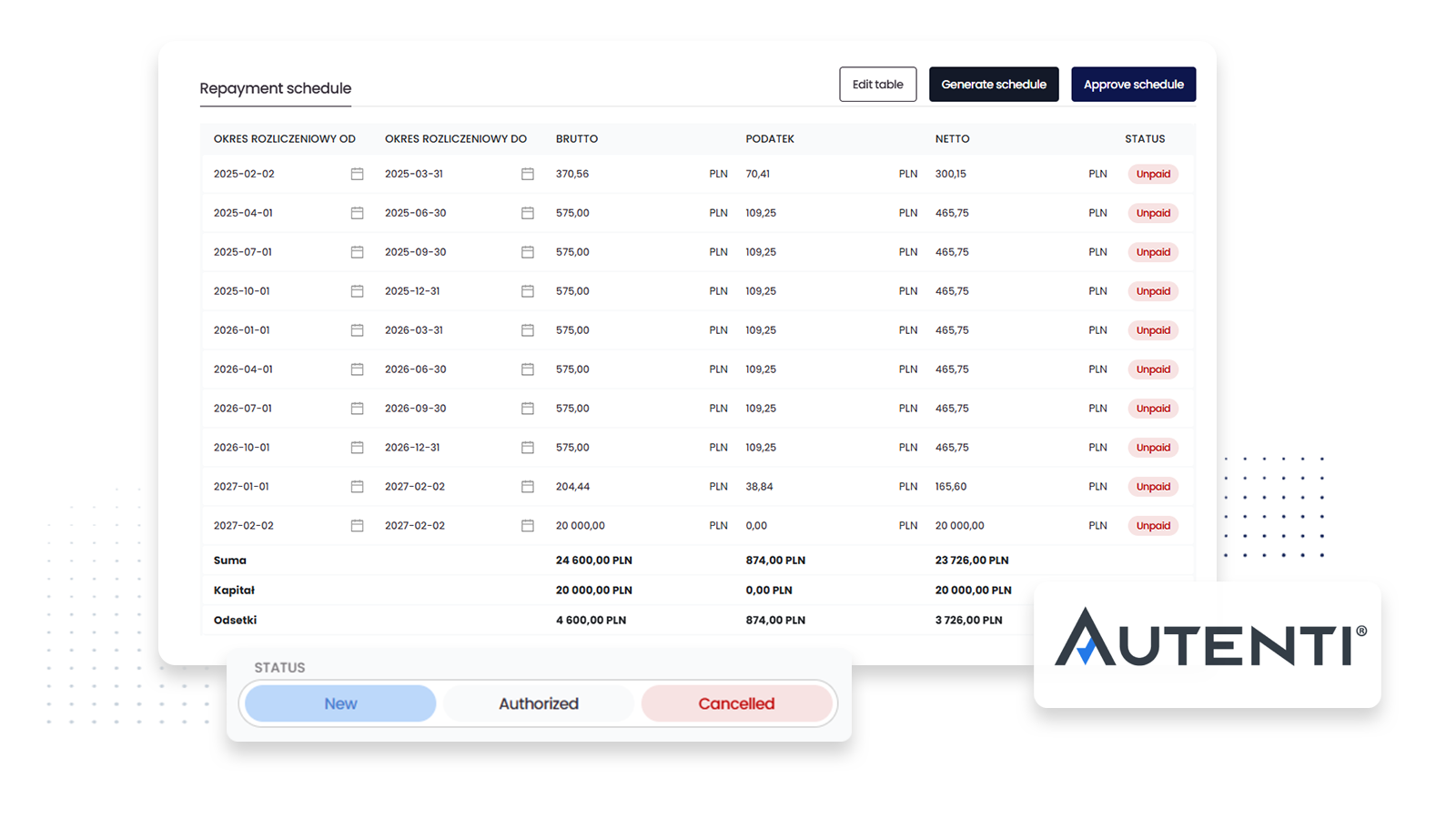

Fundequate offers a template-based contract generator that automates contract creation and the scheduling of interest repayments. Integration with Autenti enables fast and secure online signing. Documents follow a standardized format without the possibility of modification by advisors, ensuring consistency and compliance with procedures.

We provide comprehensive debt issuance management, including the recording of each loan and its settlement according to the generated schedule. Fundequate enables real-time tracking of payments, interest, and principal repayments, ensuring full control over the issuer’s obligations. Every transaction is documented, and data is available in real time, guaranteeing transparency and facilitating collaboration with lenders.

Fundequate enables debt issuers to efficiently manage internal and external distribution networks through online access to a dedicated advisor panel. This allows each advisor to view the investment campaigns assigned to them and continuously track the status of their leads in real time.

We know how complex the decision path can be when you are looking for an efficient source of funding. We provide a platform for comprehensive debt issue management and servicing.

Our platform enables developers to raise funding from individual and institutional investors, offering full management of the investment process in a white label model.

Our platform allows for rapid capital raising, fully automated billing, and a convenient system to monitor project progress and results.

We handle different types of real estate projects, from residential buildings to commercial investments. We adapt the financing conditions individually.

Our platform provides full legal support, regulatory compliance and data security, which minimises risk for investors.

Does the platform offer support in managing loan settlements?We require basic project and financial documentation. Our team analyses each investment before approving it on the platform.

Yes, our platform automates interest calculations, repayment schedules and deposit monitoring, which simplifies the management of financing.

Investors create an account, browse available projects and make investments online. Our platform provides transparency and a convenient system for monitoring progress.

Yes, we generate detailed reports that show the status of investments, transaction history and repayment status, enabling you to have full control over your finances.

Yes, we offer a white label model, so the platform can be tailored to your brand and fully personalised.

Our support team is available by email or telephone, ready to answer any questions you may have about operating the platform.

Schedule demo and find out how Fundequate can support your investment management business.