At Fundequate, we understand the unique needs of Limited Partners and institutional investors seeking both high-quality investment opportunities and the tools necessary for effective monitoring. Our tailored solutions are designed to provide unparalleled access to exclusive Venture Capital (VC) and Private Equity (PE) deals, while enabling you to track and manage your portfolio with complete transparency. With Fundequate, investors gain insight, control, and confidence throughout their investment journey.

Gain entry to a carefully curated selection of VC and PE investment opportunities that align with your strategic goals. Fundequate collaborates with top-performing fund managers, allowing investors to participate in exclusive deals that may otherwise be inaccessible. Our platform connects you directly to promising investment vehicles, ensuring a steady pipeline of high-quality opportunities tailored to your preferences.

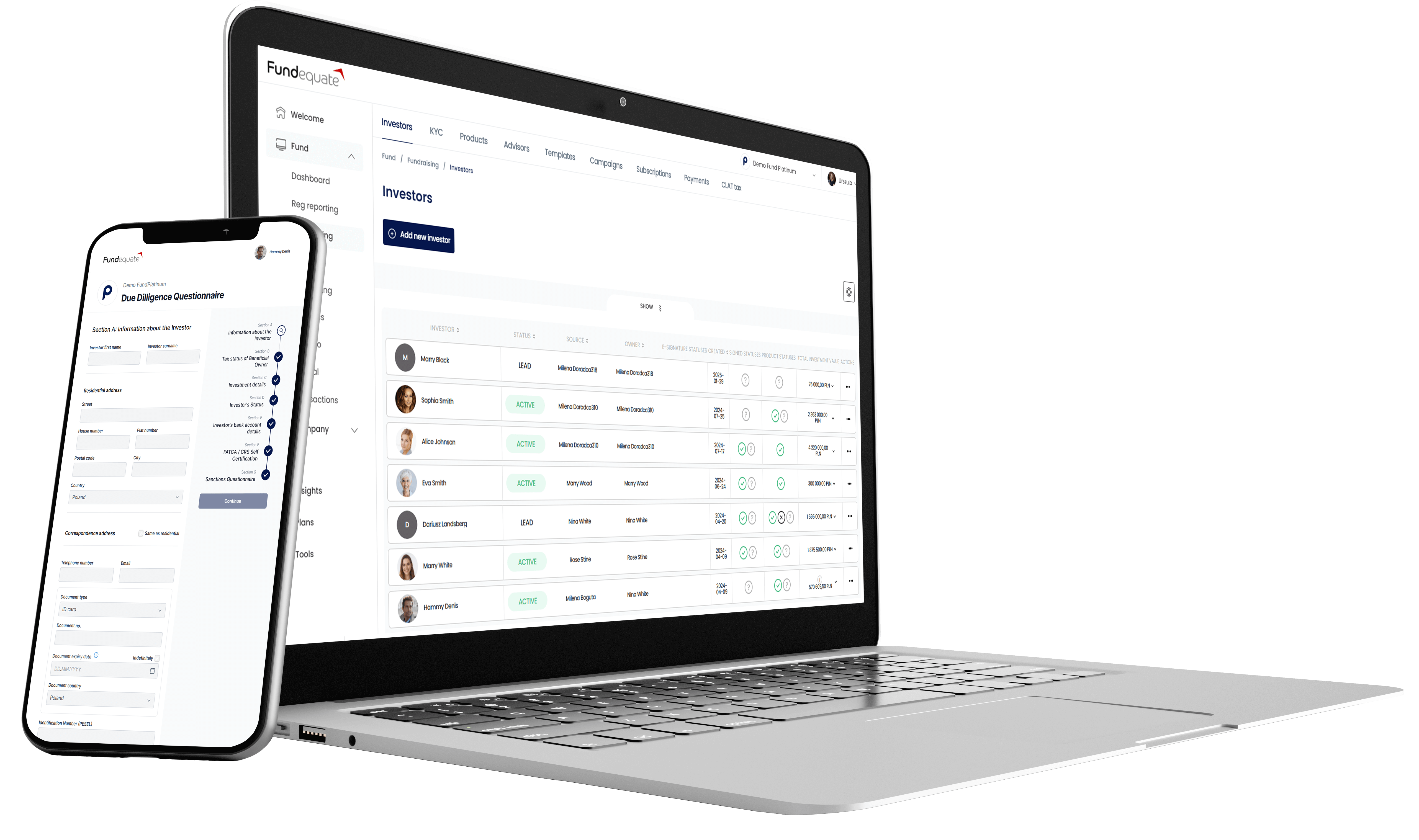

For Limited Partners, investment monitoring is as crucial as access. Our advanced tools empower you to keep track of each investment’s performance in real time, enabling data-driven decisions at every stage of the investment cycle.

Fundequate’s solution equips you with the insights needed to make informed decisions in the fast-evolving VC/PE landscape. Our platform synthesizes complex investment data into actionable insights, supporting you in achieving your financial goals and capitalizing on market opportunities.

Investors turn to Fundequate for a competitive edge in navigating the complexities of alternative investment markets. By combining access to top-tier deals with best-in-class portfolio management, we empower you to maximize returns while ensuring rigorous compliance and risk management.

Partner with Fundequate to experience a transformative approach to investment and portfolio management. From accessing exclusive VC/PE deals to gaining real-time insights, Fundequate’s solutions empower Limited Partners and institutional investors with the tools, access, and expertise needed to thrive in today’s dynamic investment landscape.

Take control of your investment future with Fundequate and navigate the evolving market with confidence.

We know how complex the decision path can be when you are considering capital allocation. We know all about investment vehicles and are happy to help you through the process.

Investors can access a range of services including investment screening, onboarding, portfolio tracking, performance analytics, and detailed reporting to monitor and optimize their investments.

Real-time portfolio tracking provides insights into performance metrics, trends, and potential opportunities, helping investors stay informed and make timely decisions.

Yes, investment platforms often manage regulatory compliance to ensure investments meet relevant laws and standards across different regions.

Analytics may include ROI tracking, risk assessment, trend analysis, and performance benchmarks to help investors evaluate and manage their portfolio health.

Yes, many platforms offer customizable reporting options so investors can focus on the metrics and updates that align with their individual goals.

Platforms prioritize data security, employing encryption, access controls, and regular audits to protect investor information.

Automated onboarding features with digital documentation and compliance checks make the process smooth and efficient for new investors.

Investors have access to dashboards, periodic reports, and performance updates, which provide a clear view of investment status and returns.

Yes, most platforms provide continuous support, including platform guidance, customer service, and updates to enhance the user experience.

Platforms often include data-driven insights and trend analysis, helping investors discover potential opportunities and make proactive adjustments to their portfolio.

Schedule demo and find out how Fundequate can support your investment management business.