Fundequate simplifies reporting for portfolio companies, ensuring transparent communication with investors. Our platform provides real-time tracking of performance metrics and financial results, enabling informed decision-making. With customizable reporting tools, we help portfolio companies strengthen investor relations through timely, data-driven updates. Fundequate offers a streamlined, comprehensive solution for portfolio companies looking to improve transparency in their investor reporting. Recognizing the essential role of clear communication, our platform empowers companies to deliver real-time, data-driven updates, ensuring investors stay informed about key performance metrics and financial outcomes.

Why Fundequate?

Real-Time Performance Tracking

With Fundequate, portfolio companies can monitor and report on vital performance metrics as they evolve. This real-time tracking enables investors to access up-to-date insights, fostering informed decision-making without delays or information gaps.

Customizable Reporting Tools

Every company and investor relationship is unique, with different expectations and requirements. Our customizable reporting tools allow companies to tailor reports to meet specific investor needs, presenting information in a format that aligns with established goals and preferences.

Enhanced Investor Relations

Fundequate’s platform helps companies build trust and confidence with their investors through consistent, timely updates. By providing accurate, data-rich reports, portfolio companies can showcase their performance transparently, encouraging a deeper understanding and stronger partnerships with investors.

Comprehensive Financial Reporting

Financial transparency is crucial for investor relations. Fundequate simplifies financial reporting, ensuring that results are presented clearly and concisely, facilitating easier analysis and a more informed investment community.

Data-Driven Decisions

Our platform promotes data-driven decision-making by providing essential insights and trends in an accessible manner. This empowers investors to make informed choices based on real-time performance and financial data, ultimately driving better outcomes for both companies and stakeholders.

By choosing Fundequate, portfolio companies can enhance their reporting practices, build stronger investor relationships, and drive greater alignment and accountability. Whether for regular updates or in-depth quarterly reviews, Fundequate is the ideal solution for portfolio companies aiming to excel in investor reporting and communication.

We know how complex the decision path can be when you are planning a SPV. We know all about investment vehicles and are happy to help you through the process.

Financial reports should include revenue, gross margin, EBITDA, cash burn rate, and runway, which provide a clear picture of financial health. For SaaS companies, Annual Recurring Revenue (ARR) is crucial, while other industries might emphasize different metrics like customer acquisition cost (CAC) or lifetime value (LTV). Consistency and transparency in reporting these metrics over time are essential.

The frequency of updates depends on the company’s stage and investor preferences. Early-stage startups often report monthly to keep investors closely aligned, while growth-stage or established companies typically send quarterly updates. Significant events, like fundraising or market shifts, may warrant ad hoc reporting.

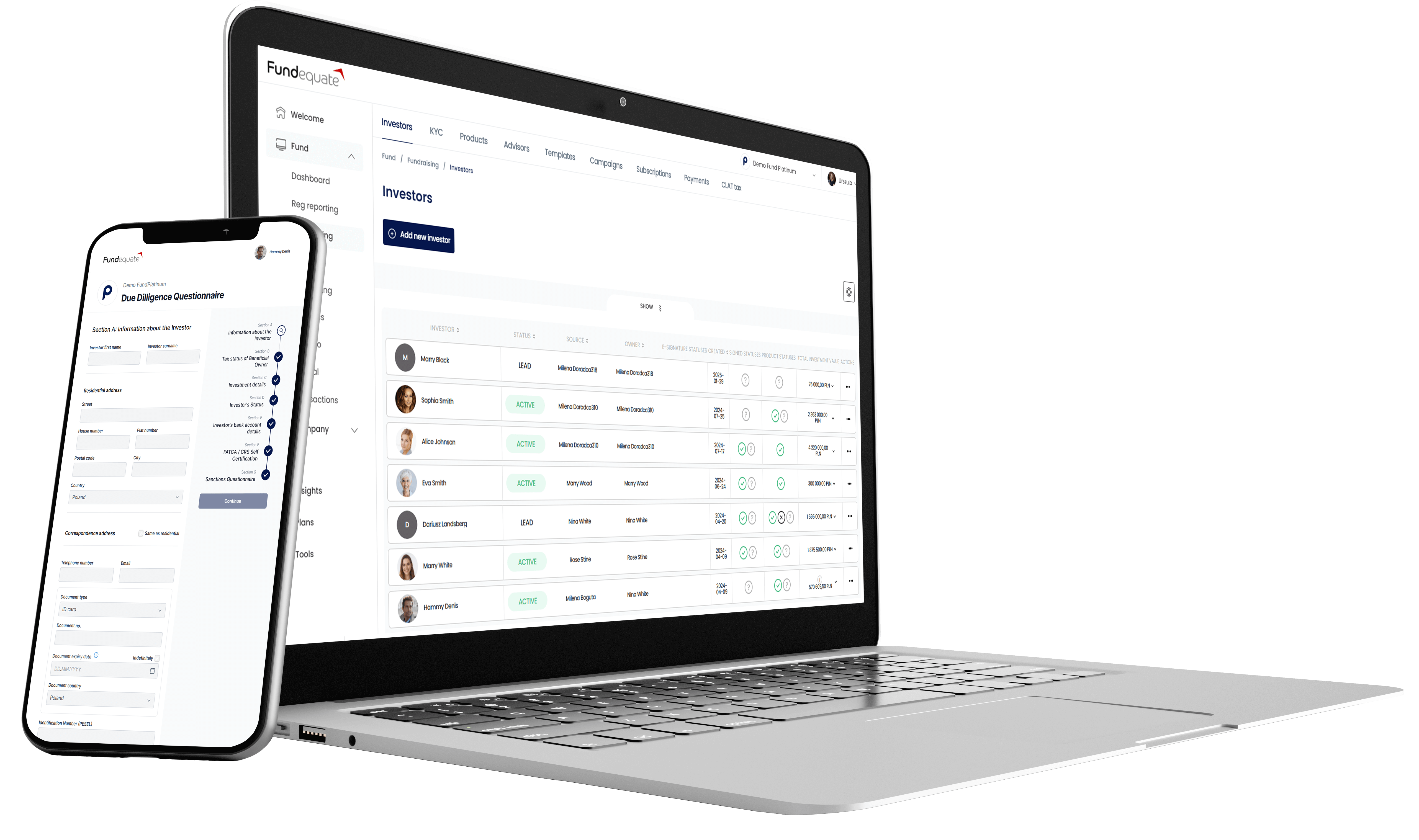

Financials are often shared via standardized templates in Excel, PDF summaries, or through platforms like Carta or Fundequate. Visual dashboards and charts can simplify complex data, making trends and key insights easily digestible, while email updates remain a standard method for distributing reports.

KPIs should align with the company’s strategic goals and investor expectations. Highlight industry-relevant KPIs such as churn rate for subscription businesses or average deal size for B2B companies, including context and trends over time. A balance between numeric data and explanatory commentary ensures clarity.

Investors expect a balance of high-level summaries (e.g., revenue and profit margins) with detailed insights into specific areas like cash flow or sales pipeline. Include supplementary breakdowns when significant deviations occur but avoid overwhelming with unnecessary detail.

Be transparent about changes to forecasts, providing clear explanations for variances. Highlight the factors influencing adjustments, such as market conditions or operational shifts, and outline the corrective actions or strategies being implemented to address challenges.

Include updates on strategic milestones (e.g., product launches), market trends, team changes, or partnerships that impact the company’s trajectory. These insights provide context for financial performance and reassure investors about the company’s overall progress.

Communicate challenges openly, with a focus on solutions. Explain the reasons behind missed targets, such as market fluctuations or operational delays, and outline specific corrective actions being taken. Demonstrating accountability builds trust with investors.

Establish a centralized system for tracking investor communications, such as a CRM tool or a dedicated investor relations contact. Promptly address queries, provide clarifications, and include common concerns in subsequent reports to ensure alignment and transparency.

Use encrypted email services, password-protected documents, or secure investor portals to share sensitive financial information. Ensure compliance with data protection laws, and confirm that all parties understand the protocols for accessing and using the data.

Schedule demo and find out how Fundequate can support your investment management business.