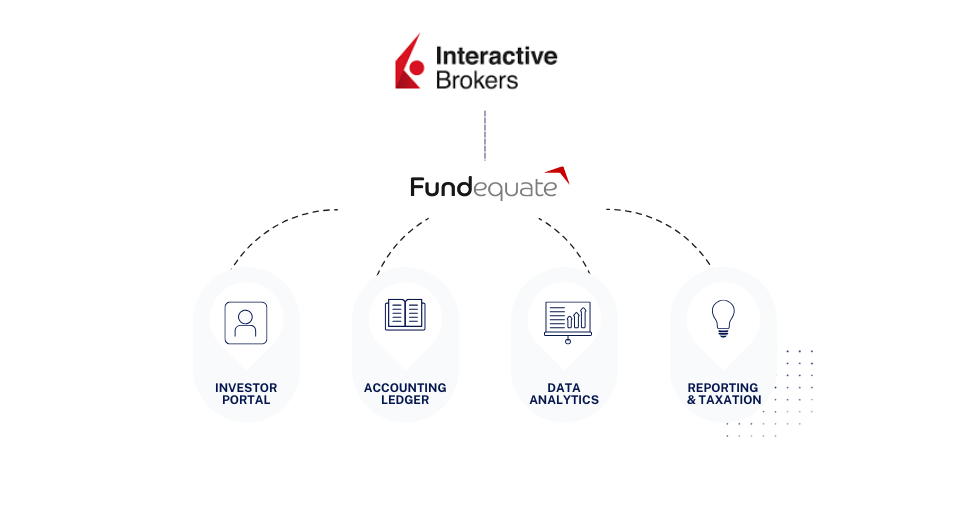

From broker to ledger: End-to-end Interactive Brokers data automation

The integration enables full financial transaction capture from Interactive Brokers accounts. All trading activities – buys, sells, dividends, foreign exchange, and corporate actions – are imported into the Fundequate system in real time or at defined intervals. This ensures that each movement on the IBKR account is mirrored accurately in the fund’s accounting system.

Fund managers can choose the integration mode that best fits their operations: via direct API connection for real-time updates, via CSV files for more controlled processing, or through scheduled batch imports. These flexible options accommodate different infrastructure setups and operational preferences.

Crucially, all imported transactions are automatically mapped into the general ledger and the fund’s portfolio valuation system. This significantly reduces operational complexity, eliminates human error, and provides a consolidated and audit-ready view of the fund’s financials.

Built-in compliance: Regulatory and tax alignment

Compliance is a central concern for all AIFMs—especially those operating under Luxembourg law, where managers are required to adhere to both the European AIFMD framework and specific domestic requirements from the Commission de Surveillance du Secteur Financier (CSSF). The Fundequate x IBKR integration supports this complex regulatory landscape by embedding compliance logic directly into the platform.

📌 AIFM/AIF obligations under two regulations:

Article 23 of AIFMD, which mandates that AIFMs provide investors with a broad range of disclosures – both prior to investment and on a recurring basis.

CSSF Circular 18/698, which establishes the conditions for authorization and ongoing operation of Luxembourg-domiciled investment fund managers (IFMs).

Alternative Investment Fund Managers Directive (AIFMD) is defined in Article 23

One of the core obligations under the Alternative Investment Fund Managers Directive (AIFMD) is defined in Article 23, which mandates that AIFMs provide investors with a broad range of disclosures—both prior to investment and on a recurring basis. These include:

AIF investment strategy and objectives

Types of assets the fund may invest in

Use of leverage and associated risks

Risk profile and liquidity management

Information about the depositary and delegated functions

Historical performance and related investor reports

Fundequate automates and standardizes many of these reporting elements. For example, exposure to financial instruments—a required data point for investor transparency and risk monitoring—is automatically computed using live trading data from Interactive Brokers. Leverage calculations (gross and commitment methods), portfolio concentration metrics, and counterparty exposures can be reported accurately and in alignment with Article 23(4)(a–g).

CSSF Circular 18/698

Furthermore, the integration aligns with the comprehensive governance framework outlined in CSSF Circular 18/698, which establishes the conditions for authorization and ongoing operation of Luxembourg-domiciled investment fund managers (IFMs). This includes AIFMs under the Law of 12 July 2013.

Specifically, Circular 18/698 requires IFMs to:

Maintain robust internal control mechanisms

Implement comprehensive risk and valuation frameworks

Ensure centralized administration in Luxembourg

Uphold AML/CFT obligations under CSSF Regulation 12-02

Comply with detailed delegation and substance requirements

Fundequate helps meet these standards by centralizing operations, maintaining a real-time audit trail of all brokerage activity, and facilitating automated NAV production and reconciliations. The system’s architecture supports structured documentation for fund boards, depositaries, and external auditors—directly derived from underlying brokerage transactions, removing the risk of human error and ensuring traceability.

Additionally, the platform’s ability to generate depository support reports and investor disclosures from validated trade data enhances both governance and investor protection—key priorities under Circular 18/698.

Investor transparency in real time

The integration extends beyond internal operations to enhance the investor experience. Through the investor portal powered by Fundequate, investors can access real-time data sourced directly from IBKR. This includes online access to account positions, valuation history, and capital account balances—available securely and on demand.

There’s no longer a need to wait for quarterly PDFs or request ad-hoc reporting from the administrator. Investors can view live snapshots of their allocations, download performance statements, and track investment activity as it happens.

Importantly, the system supports structured reporting across compartments, SPVs, and umbrella funds. While fund managers maintain full oversight across the fund structure, each investor only sees data relevant to their investment—ensuring data security and transparency at the same time.

Fund structuring and reconciliation made simple

In line with Luxembourg market trends, where AIFs often operate through umbrella structures, special limited partnerships (SLPs), or dedicated SPVs, the integration handles multi-entity reporting with ease. Fundequate supports automated reconciliation between brokerage activity and accounting records, enabling efficient handling of sub-funds, parallel vehicles, and holding companies.

Whether you’re onboarding external capital into an SPV, managing trading-intensive compartments, or operating a cross-border fund structure, this infrastructure ensures operational clarity and administrative efficiency. The system is scalable, adaptable, and ready for the demands of sophisticated fund setups.

An integrated platform for modern fund operations

The integration of Fundequate with Interactive Brokers is more than a technical feature—it’s a strategic enabler for active fund managers. With direct data pipelines, automated exposure tracking, tax-compliant reporting, and a real-time investor portal, this solution redefines how AIFMs manage their operations.

For Luxembourg-based managers navigating CSSF and AIFMD obligations, or global fund managers seeking scale and transparency.

Author and expert

Dariusz Landsberg, FCCA

CEO Fundequate

FAQ

What is the benefit of integrating Interactive Brokers with fund management platforms?

Integrating Interactive Brokers enables real-time trade data to flow into fund platforms, which helps automate NAV calculations, reduce manual errors, and support faster decision-making. Solutions like Fundequate offer this integration as part of a digital AIFM operating model.

Can Interactive Brokers connect to fund accounting systems?

Yes, Interactive Brokers provides APIs and data export options that allow integration with fund accounting systems for automated reconciliation, trade booking, and ledger generation. Platforms such as Fundequate support this connection end-to-end.

Which fund accounting systems are commonly used with broker integrations?

Popular accounting systems include Allvue, Efront, FundCount, and PAXUS. These tools can be integrated through middleware or full-suite platforms like Fundequate, which map broker data directly into fund accounting workflows.

How does integration help with NAV calculation for actively trading funds?

It enables up-to-date position tracking and P&L calculation, allowing accurate and efficient NAV production. This is particularly useful for long/short strategies or funds trading daily. Fundequate supports real-time NAV syncing from brokers like Interactive Brokers.

What are key features of a modern investor portal linked to fund systems?

Modern portals provide secure access to capital accounts, NAV updates, distribution notices, and audited reports. Platforms like Fundequate offer customizable, branded portals integrated with back-office data and broker positions.

Can investors view their holdings and performance metrics in real time?

Yes, when systems are connected to brokers, investors can view their allocation, performance, and fund metrics with minimal delay. Fundequate’s investor portal enables this through a real-time data pipeline from execution to reporting.

How does broker integration assist with AIFMD and CSSF reporting requirements?

Data from brokers feeds directly into compliance modules that automate Annex IV reports, AML monitoring, and CSSF-specific templates (e.g., under Circular 18/698). This is a core feature of platforms such as Fundequate, which are tailored for Luxembourg AIFMs.

Is integration between Interactive Brokers and fund systems secure and compliant?

Yes. API-based integrations use encryption, access controls, and audit logs to comply with EU data protection laws and financial regulations. Fundequate follows regulatory-grade security standards as part of its infrastructure.

Can fund platforms work with multiple brokers and custodians?

Absolutely. Fund platforms are often designed to be broker-agnostic, supporting multiple data sources and custodians. Fundequate allows users to integrate Interactive Brokers alongside other providers in a single dashboard.

What setup is required to link Interactive Brokers with fund systems and investor portals?

Setup typically involves API configuration, access credentialing, and data mapping. A unified platform like Fundequate simplifies this by managing the integration and aligning it with your fund’s accounting and reporting setup.