In Luxembourg’s robust alternative investment ecosystem, the pathway to fundraising depends significantly on the regulatory status of the AIFM. While some structures must rely strictly on reverse solicitation, authorised AIFMs benefit from EU-wide marketing capabilities, including formal pre-marketing and distribution rights under the Alternative Investment Fund Managers Directive (AIFMD).

This article focuses exclusively on Luxembourg AIFs managed by authorised AIFMs, outlining what is permitted when engaging with professional investors and what regulatory safeguards must be respected.

Understanding Authorised AIFMs

An authorised AIFM is a fully licensed alternative investment fund manager regulated by the CSSF and compliant with the Law of 12 July 2013, which transposes the AIFMD into Luxembourg law. Once authorised, the AIFM may manage and market AIFs across the EU using the AIFMD passport.

This status is required for AIFMs managing:

Over EUR 100 million in assets with leverage, or

Over EUR 500 million in assets without leverage.

Authorised AIFMs are uniquely positioned to pursue regulated and scalable capital raising strategies. Authorised AIFMs can:

Pre-market and market AIFs to professional investors across the EU using the AIFMD marketing passport.

Establish branches or use local distributors in other Member States without needing national licences.

Offer AIFs structured under a wide range of vehicles (e.g. RAIF, SIF, SICAR, SCSp).

This passporting capability is a key reason Luxembourg is the preferred jurisdiction for scaling cross-border AIF strategies.

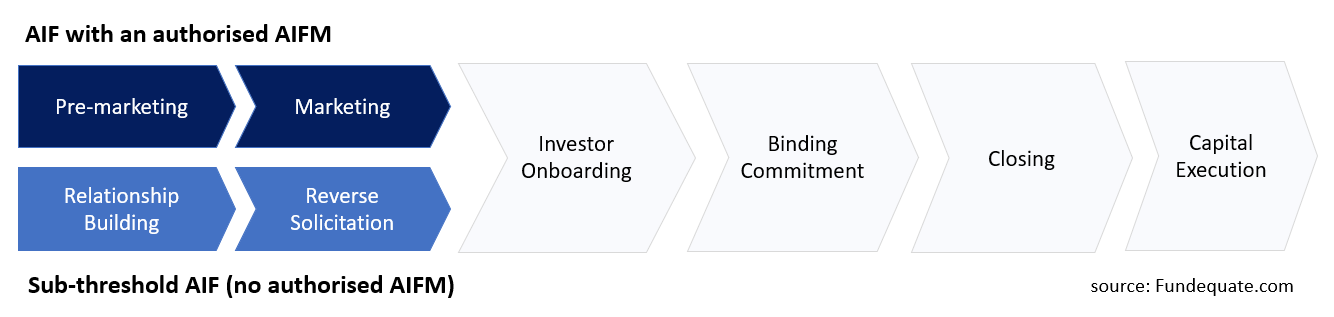

The Investor Lifecycle of a Luxembourg AIF

Raising capital for an Alternative Investment Fund (AIF) in Luxembourg is not a single-step event—it is a regulated, multi-phase lifecycle. The early stages of this process are determined primarily by the fund’s regulatory setup, specifically whether it is managed by a fully authorised AIFM or a sub-threshold (registered) AIFM. Below is a visual overview of the typical investor journey, starting from first contact through to capital execution:

Two distinct regulatory tracks:

AIFs with an authorised AIFM:

These funds benefit from the full AIFMD marketing passport, allowing them to actively engage professional investors throughout the EU. Their investor lifecycle begins with:

Pre-Marketing: Testing investor appetite with draft materials

Marketing: Official offering of fund units once approved

Sub-threshold AIFs (no authorised AIFM):

These are subject to significant restrictions. They cannot legally market their funds and must instead rely on:

Relationship Building: Maintaining direct personal contact networks

Reverse Solicitation: Responding passively to investor-initiated interest

After these distinct initial phases, both tracks generally converge at the same steps:

Investor Onboarding: KYC/AML, documentation, system onboarding

Binding Commitment: Execution of the LPA or subscription documents

Closing: First (or subsequent) fund closing

Capital Execution: Drawing down capital and executing the investment pipeline.

Pre-Marketing: Preparing the Ground

Legal Basis:

- Article 30a of AIFMD (as amended by Directive (EU) 2019/1160)

CSSF Circular 21/778

Definition:

Pre-marketing is the set of activities conducted by an authorised AIFM or its intermediaries to test the interest of potential professional investors before the AIF is formally offered. These activities must not constitute an offer or placement of fund units.

Permitted Activities:

Sharing teasers, pitch decks, or slide decks

Distributing draft documents clearly marked as “draft” (e.g., term sheet, LPA)

Hosting meetings to gather interest and feedback

Circulating non-binding expressions of interest

Restrictions:

No final subscription documents may be circulated

No binding commitments or confirmations of interest

No public advertising

CSSF Notification Requirement:

The AIFM must notify the CSSF within 2 weeks of commencing pre-marketing. This includes:

Description of the pre-marketing activity

Target countries

Confirmation that investors are professional

Best Practice Tip: Maintain internal records of all materials and communications distributed during pre-marketing for audit purposes.

Marketing: Launching the Offering

Legal Basis:

Articles 31 and 32 of AIFMD

Definition:

Marketing refers to any direct or indirect offering or placement of units or shares of an AIF to professional investors within the EU, once the fund is ready for subscription.

Activities:

Distribution of final fund documentation (PPM, LPA)

Execution of subscription documents

Active fundraising through events, calls, or digital channels

AIFMD Passport:

Authorised AIFMs may market the AIF across all EU Member States by notifying the CSSF and submitting a marketing notification that includes:

Host Member States

Fund documentation

Summary of key terms and disclosures

Once the CSSF approves and transmits the notification to host authorities, the AIFM may begin marketing without further national approvals.

Investor Onboarding

Under Luxembourg’s Anti-Money Laundering Law (12 November 2004) and CSSF Regulations (e.g. RCSSF No 12/02 and 16/07), an AIFM or GP is legally required to conduct investor due diligence before accepting any subscription or establishing a business relationship with an investor.

This phase ensures compliance with:

AML/CTF rules

FATCA / CRS tax reporting obligations

Sanctions and politically exposed person (PEP) screening

Regulatory Clearance Requires:

Completion of a KYC/AML Questionnaire

Submission of Supporting Documents

FATCA/CRS Self-Certification Forms

Automated Screening

Internal Risk Classification

Blocking Rule:

No investment commitment, subscription, or document execution may occur until KYC/AML checks are completed and validated. This is mandated under Luxembourg AML regulations.

Allowed Documents:

KYC/AML Questionnaire

FATCA/CRS Forms

Proof of ID / address

Draft fund documents for review (no execution)

Key Regulatory References:

Law of 12 November 2004 (as amended)

CSSF Regulation 12/02 (Customer Due Diligence)

CSSF Regulation 16/07 (ECDD / Ongoing Monitoring)

AIFMD Recital 41 & Article 20 (delegation responsibilities)

Compliant Capital Raising

Authorised AIFMs managing Luxembourg AIFs have a powerful toolkit to engage EU professional investors through pre-marketing, formal marketing, and onboarding phases. By aligning their strategy with the AIFMD framework and CSSF guidance, fund sponsors can scale capital efficiently while maintaining full regulatory compliance. Fundequate helps GPs and AIFMs navigate every step of this journey—from structuring to distribution to onboarding—through integrated workflows and regulatory support.

Author and expert

Dariusz Landsberg, FCCA

CEO Fundequate

FAQ

What is the difference between pre-marketing and marketing under AIFMD?

Pre-marketing refers to testing investor interest using draft, non-binding materials before the AIF is launched. Marketing is the formal promotion of the fund once it is live, with final documents and acceptance of subscriptions.

Who can be targeted during pre-marketing?

Only professional investors as defined by MiFID II may be approached during pre-marketing. Retail investors are strictly excluded.

What must an AIFM do before starting pre-marketing?

The AIFM must prepare compliant materials and notify the CSSF within 2 weeks of the start of pre-marketing, including a description of the activity, target jurisdictions, and investor classification.

Can draft fund documents be shared during pre-marketing?

Yes, but they must be clearly marked as “draft”, not for subscription, and may not include any means for investors to subscribe.

What triggers a regulatory breach in pre-marketing?

If a final subscription form is provided, or if any investor commits capital during pre-marketing, it is considered unlawful marketing and a breach of AIFMD rules.

How does the AIFMD passport support cross-border marketing?

Once marketing notification is approved by the CSSF, the AIFM can market to professional investors throughout the EU without needing national licences in each Member State.

Is reverse solicitation allowed for authorised AIFMs?

Yes, but it is not a substitute for pre-marketing or marketing. Reverse solicitation must be truly investor-initiated and cannot be engineered through indirect outreach.

What is required during investor onboarding?

Investors must complete full KYC/AML checks, submit FATCA/CRS self-certifications, and pass sanctions/PEP screening before any subscription can be accepted.

What documents can be shared during onboarding but before commitment?

Only non-executable fund documents, KYC forms, and identification documents may be shared before KYC validation. No final agreement can be signed.

What happens if KYC/AML is incomplete at the time of subscription?

The AIFM or GP must block any investment commitment until KYC/AML checks are validated. Accepting funds prematurely would violate Luxembourg AML laws and CSSF guidance.