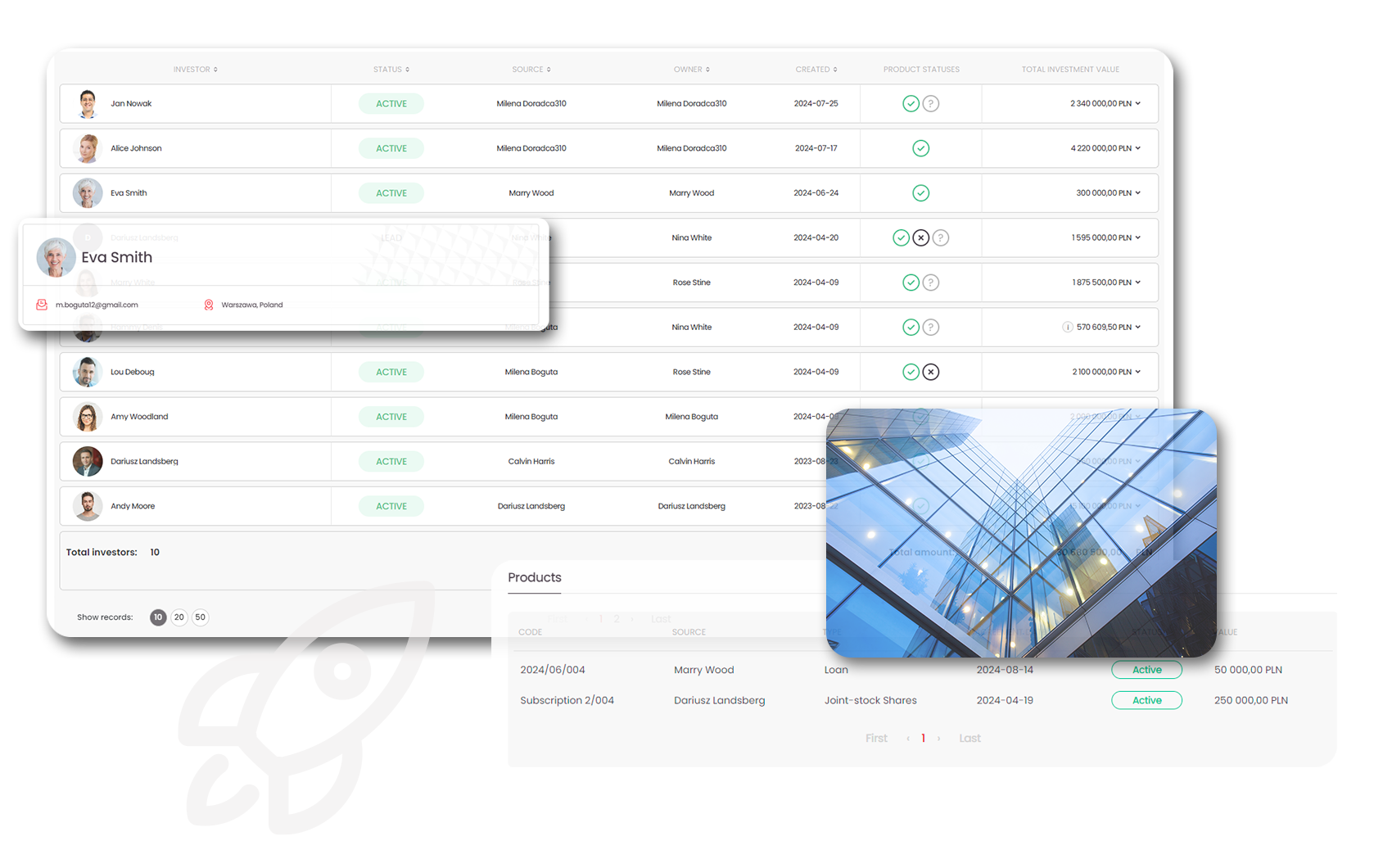

For equity issuers, Fundequate offers a module that allows the creation of outreach and investment campaigns for a closed circle of tagged investors who have expressed active interest in a VC/PE fund offering.

Fundequate automates investor onboarding, providing fast and regulatory-compliant KYC and AML processes executed fully electronically. Via API integration with Autenti and IDnow allow for verification of investor identity and status. Full integration of the investor onboarding process minimises paperwork, providing secure verification of investors’ identity and status.

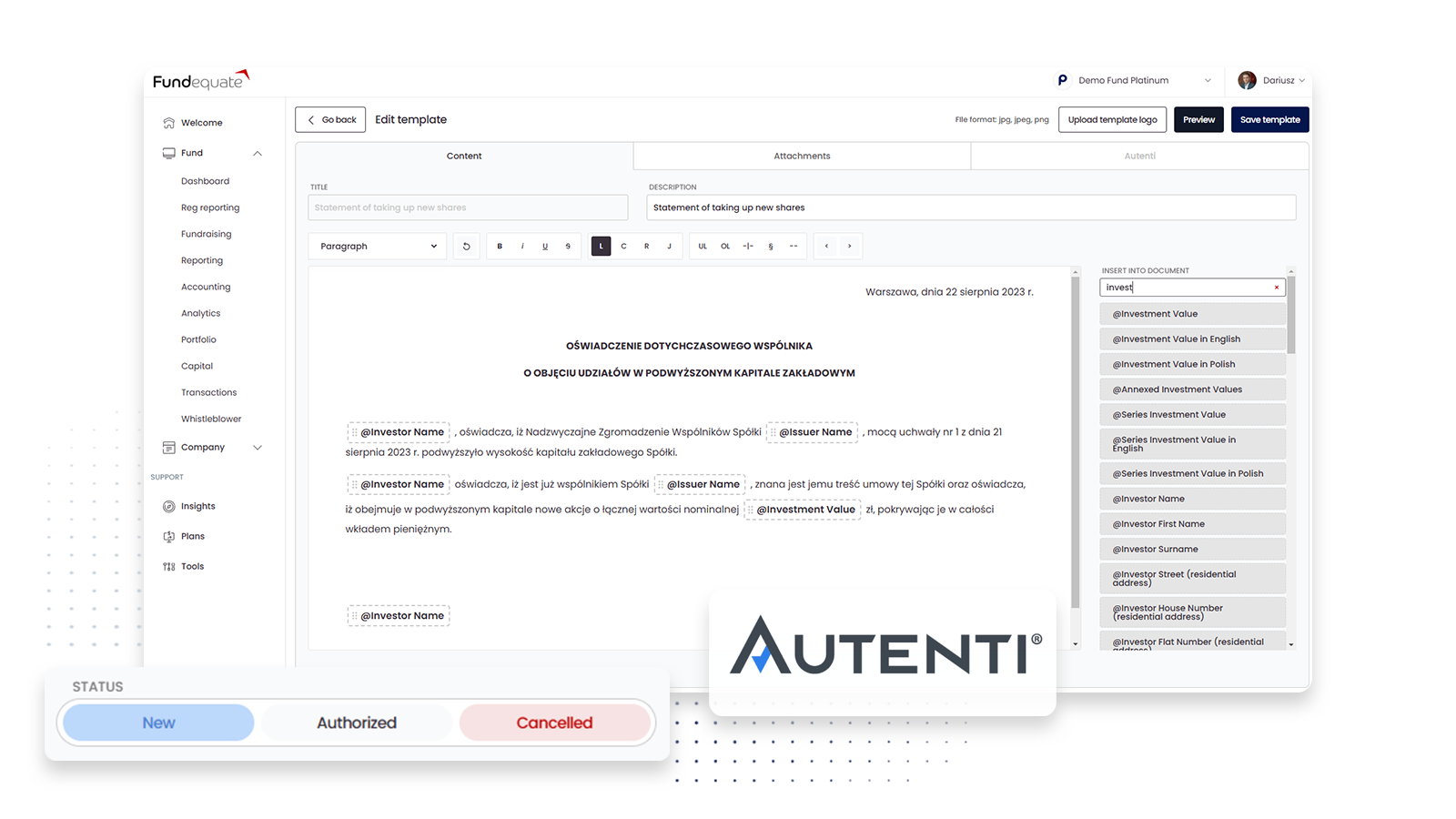

Fundequate offers a template-based contract generator that automates and standardises the document creation process. Integration with Autenti allows contracts to be signed online, ensuring fast and secure document circulation. All contracts are generated in a uniform layout, without the possibility of modification by advisers, ensuring consistency and compliance with procedures.

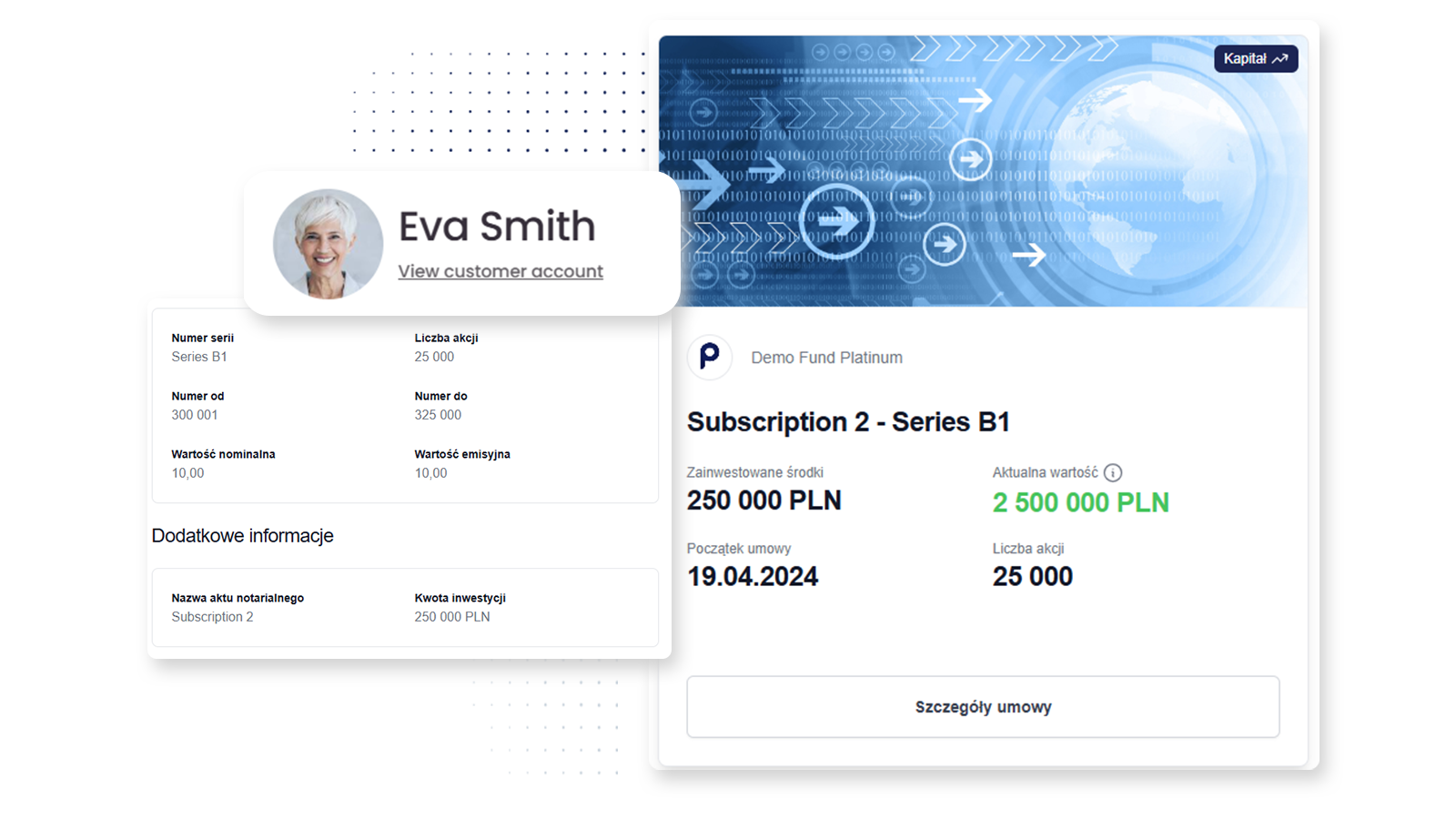

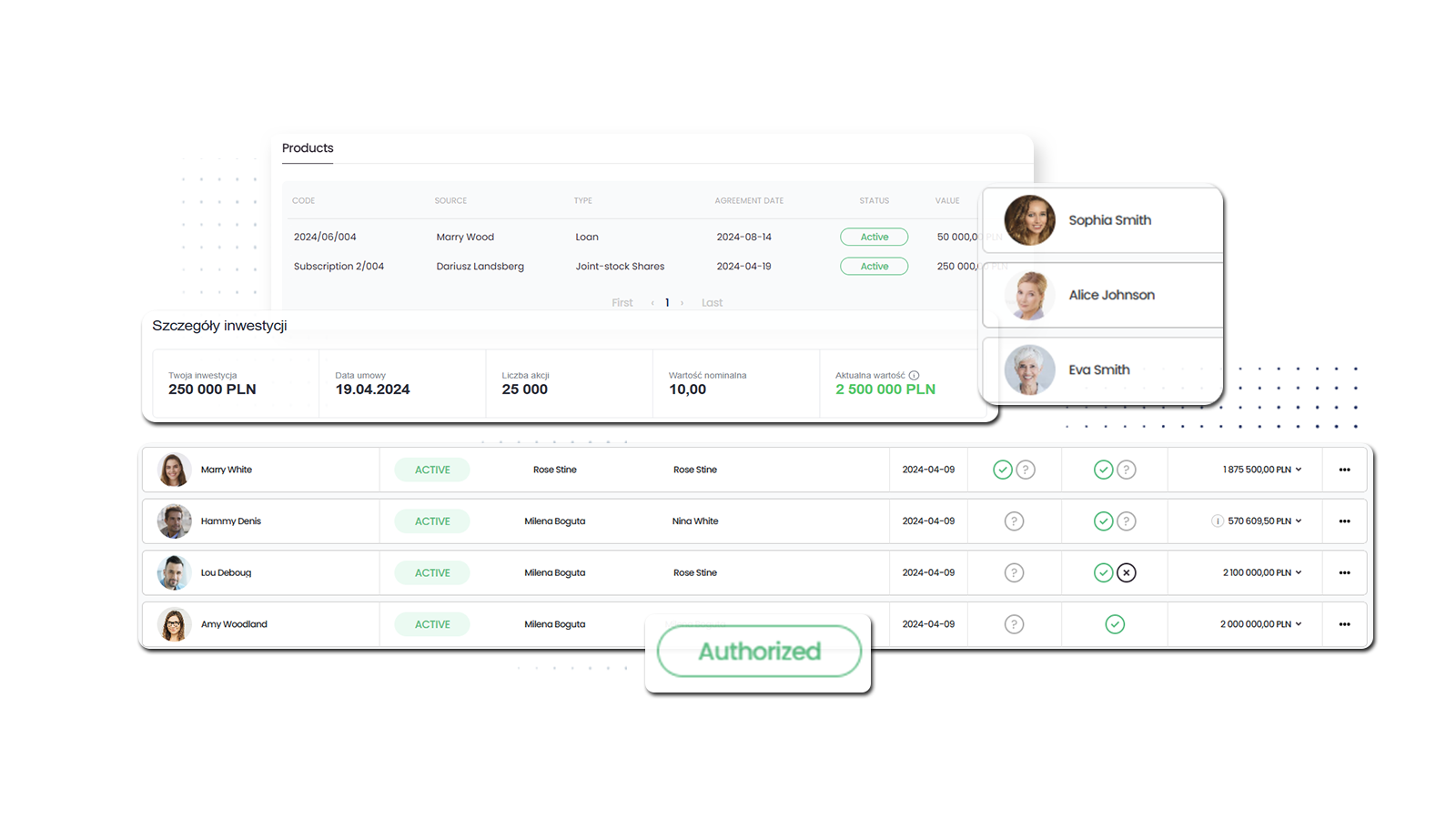

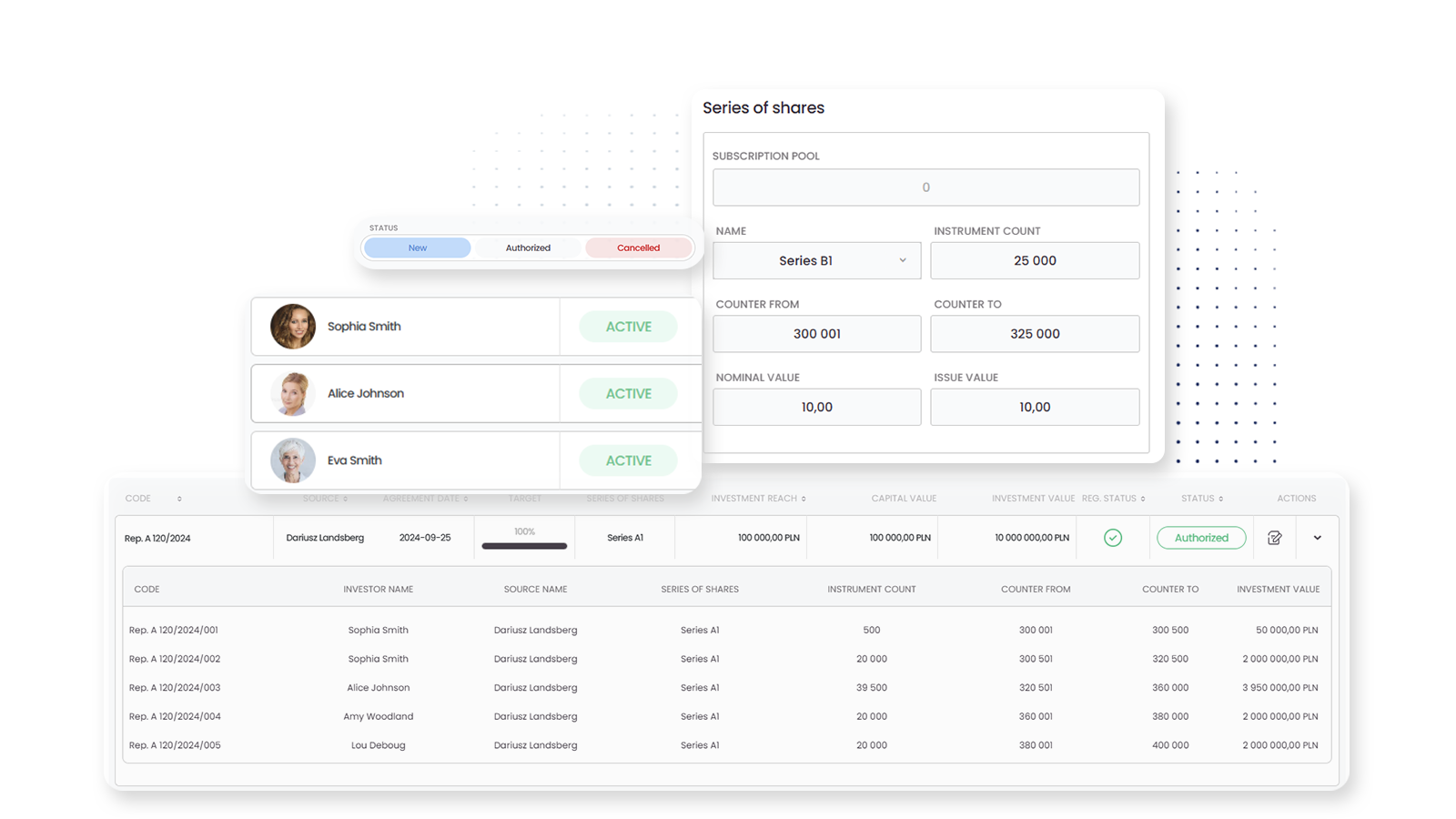

We provide a record of the fund’s capital, including a detailed record of each subscription and investment. Fundequate allows you to keep up to date with contributions, settlements and financial performance, giving you full control over the fund’s finances. Every transaction is documented and this information can be accessed in real time, enabling transparent interaction with investors.

Fundequate enables automated investor billing and management of capital calls, ensuring full compliance with fund terms. The platform handles notifications, tracks contributions and generates reports, simplifying the process of managing capital accounts.

We know how complex the decision path can be when you are planning a new fund. We know all about alternative funds and are happy to help you through the process.

Fundraising in VC funds is the process of raising capital from investors to fund innovative startups and grow the fund’s investment portfolio.

The main sources of capital are institutional investors (e.g. pension funds), families, high-net-worth individuals, foundations and corporations.

The key steps are: preparing a solid business plan, creating an attractive presentation for investors, networking and negotiating effectively.

Fundraising usually requires an information memorandum (private placement memorandum), investment agreements, financial projections and fund management data.

Investors pay attention to the experience of the management team, the investment strategy, the market potential of the portfolio companies and the fund’s past performance.

Onboarding of investors usually involves presenting legal documentation, explaining the fund’s structure, and organising meetings and presentations to answer investors’ questions.

Challenges include identifying the right investors, convincing them to invest and managing investor expectations during the process.

Due diligence is the process of thorough analysis of a fund and its investment strategy carried out by investors before deciding to invest.

There is now a growing interest in investing in technology, sustainability and health startups, which is influencing the fundraising strategies of VC funds.

VC funds focus on investing in startups and early-stage companies, while other funds, such as private equity (PE) funds, often invest in more mature companies that need restructuring or optimisation.

VC funds can communicate effectively with investors by regularly reporting investment performance, holding meetings and sending updates on the development of portfolio companies, which builds trust and long-term relationships.