We understand how complex the decision-making process can be when planning a new investment vehicle. Our expertise in this area equips us to guide you through every step of the process, ensuring you make informed choices with confidence.

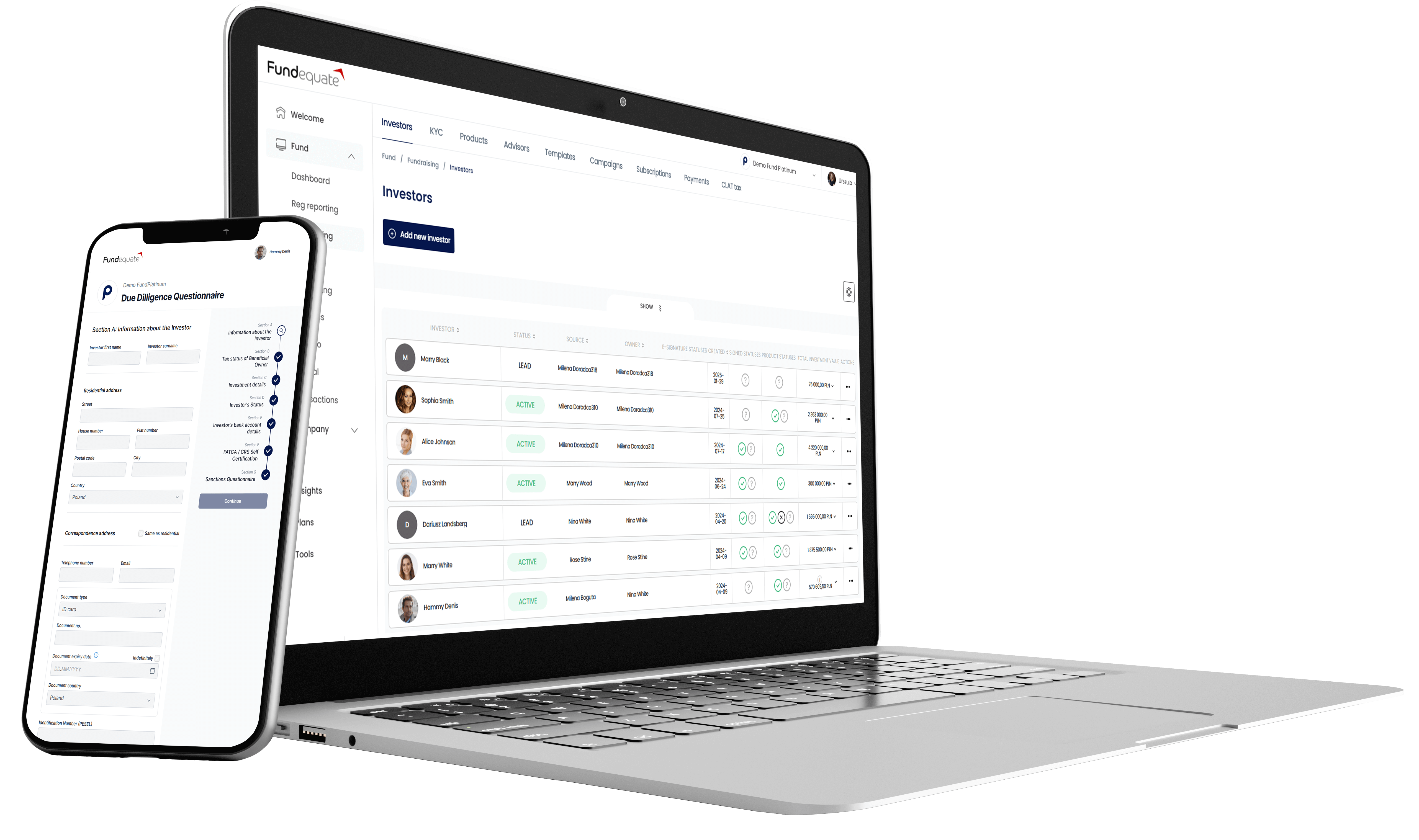

Schedule demo and find out how Fundequate can support your investment management business.