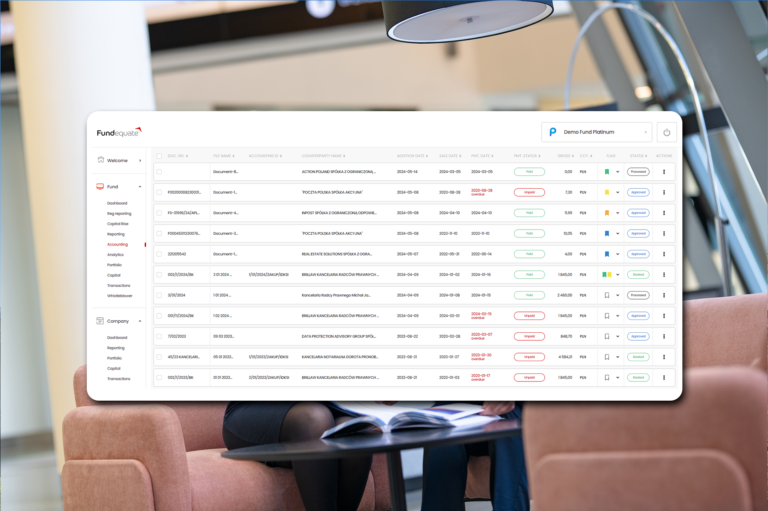

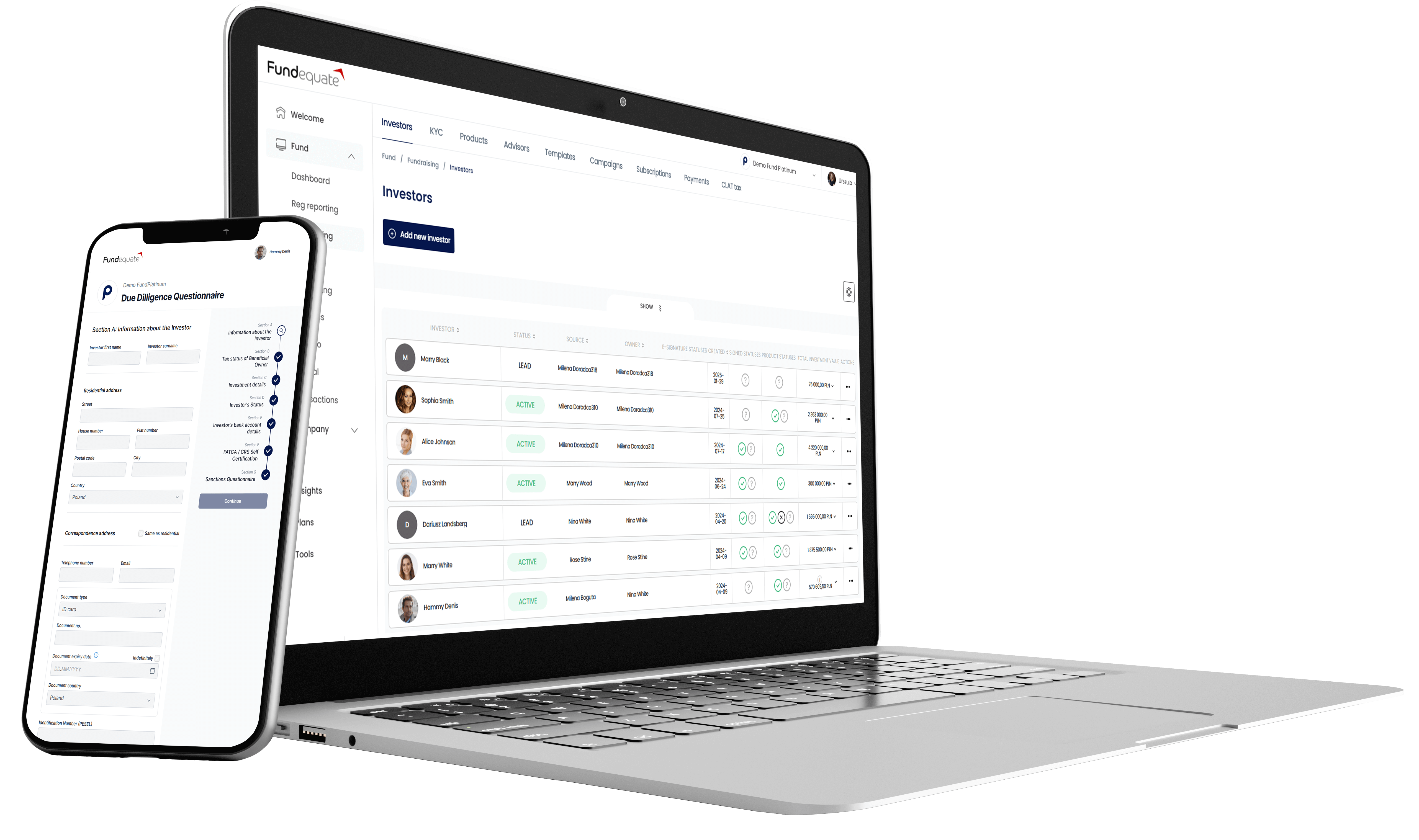

Integration of Fundequate with Interactive Brokers for actively trading alternative investment funds (AIF)

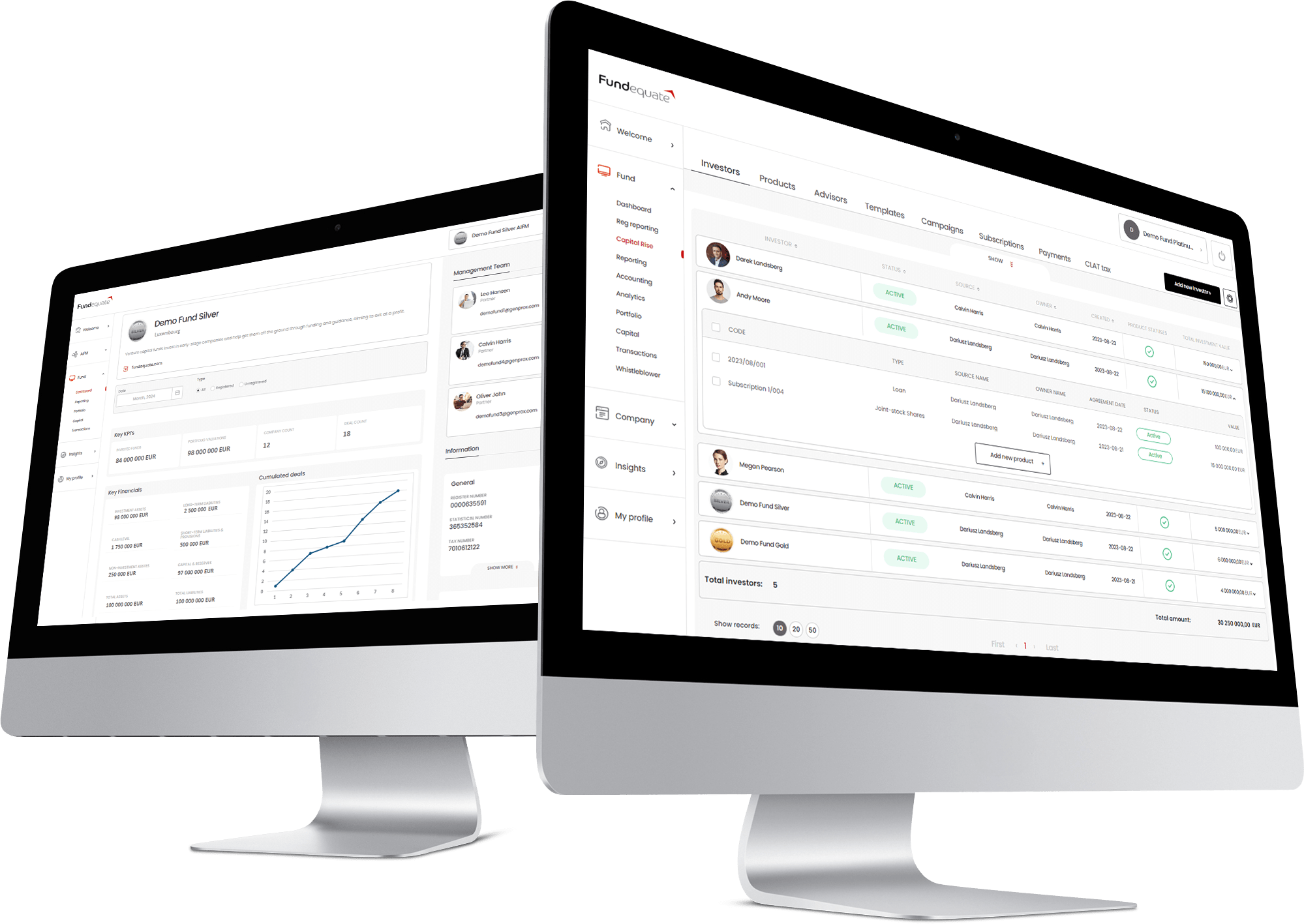

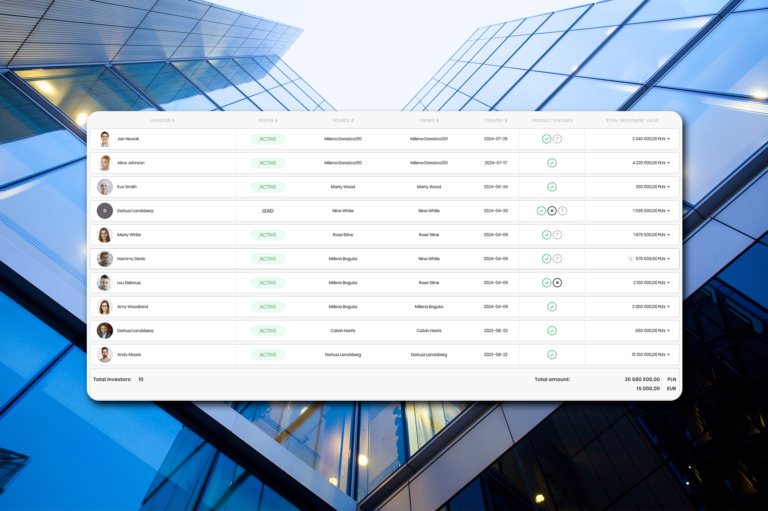

Fundequate has successfully integrated with Interactive Brokers (IBKR), creating a seamless solution for Alternative Investment Fund (AIF) managers who trade actively in financial markets. This development addresses a longstanding need in the fund management space: unifying real-time trading data with fund accounting and investor reporting. AIFMs operating in highly regulated